ADT 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

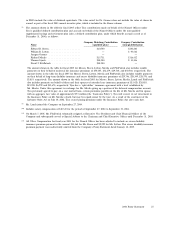

credited service specified in the table. Under the pension plan, no more than a maximum of 30 years of

credited service may be recognized for benefit accrual purposes.

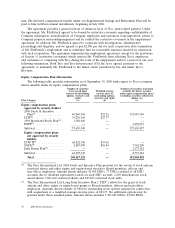

Years of Credited Service and Related Estimated

Annualized Monthly Annual Benefits Payable upon Retirement

Salary as of Three Years

Prior to Retirement 15 20 25 30

$ 896,774(1) $337,966 $473,380 $619,241 $775,475

$ 941,613 $361,147 $504,053 $657,272 $820,728

$ 986,452 $384,844 $535,278 $695,819 $866,389

$1,031,291 $409,056 $567,052 $734,878 $912,464

$1,076,128 $433,768 $599,372 $774,454 $958,967

(1) The dollar values in the table are converted from Euros using a conversion rate of A1 to $1.2058 at

September 30, 2005.

The annual benefits shown in the table assume that Dr. Gromer would receive his retirement

benefits under the pension plan in the form of a straight life annuity upon normal retirement at age 65.

As a retiree, Dr. Gromer would be required to pay medical and long-term care insurance from the

benefit provided under the pension plan. The compensation of Dr. Gromer covered by the pension

plan is his base salary amount (including both German and Swiss salary) excluding statutory payments

for Christmas and vacation pay. Dr. Gromer’s current covered compensation, designated in Euro, is

A743,717, which converts to $896,774 using a conversion ratio of 1 Euro to 1.2058 USD as of

September 30, 2005. As of September 30, 2005, for purposes of calculating benefits accrued under the

pension plan, Dr. Gromer has 27 years and 9 months of credited service with Tyco. In addition to this

pension, at September 30, 2005, Dr. Gromer had accrued a taxable pension payable at retirement by an

insurance company in the amount of A3,386 ($4,083) annually. This amount is subject to increase in

future periods only to the extent of dividends on the insurance policy.

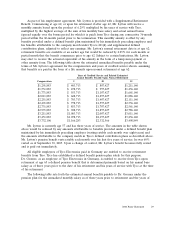

Mr. Meelia has a frozen benefit under the tax-qualified Kendall/ADT Pension Plan. The benefit

has two parts: a final average pay pension benefit and a cash balance benefit. Under the first part of

the plan, Mr. Meelia has a frozen monthly pension benefit of $139 payable immediately at

September 30, 2005. If payable at normal retirement date (age 65), this benefit would be $161 monthly.

Under the second part, he has a lump sum cash balance account of $82,629 at September 30, 2005,

which equates to an immediately payable monthly annuity of $478. Future benefit accruals under both

parts of the plan have been frozen. In addition, Mr. Meelia has a benefit under the frozen

non-qualified Kendall SERP. Mr. Meelia’s account balance under the Kendall SERP at September 30,

2005 was $104,475. The Kendall SERP benefit will be paid in a lump sum after termination of

employment.

Messrs. Breen, Lytton, Meelia, Lynch and FitzPatrick also participate in the Tyco International

(US) Inc. Supplemental Savings and Retirement Plan, which is a defined contribution plan

(Mr. FitzPatrick participates with respect to employee deferrals only). In addition to allowing employee

deferrals of up to 50% of base salary and up to 100% of annual bonus, this plan provides benefits to

selected employees who have compensation in excess of the Internal Revenue Service limits for

qualified retirement plans ($210,000 for 2005). Each year, those individuals’ bookkeeping accounts are

credited with the maximum Company contribution that could have been credited under the Company’s

tax-qualified 401(k) plan (the Tyco International (US) Inc. Retirement Savings and Investment Plan)

under its formula (regardless of the individual’s actual participation in that plan) if the compensation

limits and annual dollar limits on contributions did not apply under the 401(k) plan, less the maximum

contributions permitted under the 401(k) plan for the year. Each participant’s notional account is

credited with notional earnings and losses based on deemed investments chosen by the participant from

among those specified in the plan. Accounts under the plan become fully vested upon the earliest of

the following events: completion of three years of service, attainment of age 55 with age plus years of

total service equal to at least 60, the employee’s death or disability, or a change in control. Accounts

30 2006 Proxy Statement