ADT 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

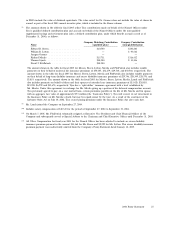

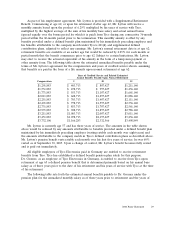

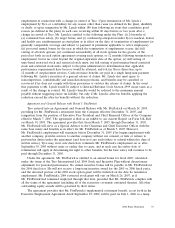

terms of Mr. Breen’s agreement for the compensation and years of credited service shown, assuming

that benefits are paid in the form of a life and 50% survivor annuity upon normal retirement at age 60.

Years of Credited Service and Related Estimated

Annual Benefits Payable Upon Normal Retirement

Compensation 5 10 15

$3,110,088 $1,555,044 $1,555,044 $1,555,044

$3,210,088 $1,605,044 $1,605,044 $1,605,044

$3,310,088 $1,655,044 $1,655,044 $1,655,044

$3,410,088 $1,705,044 $1,705,044 $1,705,044

$3,510,088 $1,755,044 $1,755,044 $1,755,044

$3,610,088 $1,805,044 $1,805,044 $1,805,044

$3,732,106 $1,866,053 $1,866,053 $1,866,053

Mr. Breen is currently age 49 and has three years of service. The amounts in the table shown

above would be reduced by Mr. Breen’s prior employer offset of $55,000 per year at normal retirement

and the amounts attributable to the company match in Tyco’s defined contribution plans as described

above. Mr. Breen’s pension benefit, as well as his prior employer offset, vest ratably each month over

his first five years of service; he was 63% vested as of September 30, 2005. Upon a change of control,

Mr. Breen’s benefit becomes fully vested and is paid out immediately.

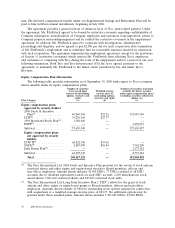

As part of his employment agreement, Mr. FitzPatrick is provided with a Supplemental Retirement

Benefit. Commencing at age 62, or upon his retirement if after age 62, Mr. FitzPatrick will receive a

monthly annuity based upon the sum of 2% multiplied by his years of service with Tyco plus an

additional 10%, multiplied by the highest average of the sum of his monthly base salary and actual

annual bonus (spread equally over the bonus period for which it is paid) from Tyco during any

consecutive 36-month period within the 60-month period prior to his termination. This monthly annuity

is offset by any benefits provided under a defined benefit plan maintained by his immediately preceding

employer and any benefits attributable to the company match under Tyco’s 401(k) and supplemental

defined contribution plans, adjusted to reflect any earnings. One-half of the monthly amount will

continue to his surviving spouse in the event of his death. Mr. FitzPatrick’s normal retirement date is at

age 62; retirement benefits are available at an earlier age but would be reduced by 0.25% for each

month or partial month that the benefit commences prior to age 62. Subject to certain limitations,

Mr. FitzPatrick may elect to receive the actuarial equivalent of his annuity in the form of a lump sum

payment or installments. Mr. FitzPatrick elected to retire effective December 31, 2005 and to receive a

lump sum payment on July 1, 2006. Mr. FitzPatrick’s estimated lump sum benefit is $3,119,000. The

actual amount paid will depend on the annuity rates in effect at the time of his payment.

Mr. FitzPatrick is currently age 51 and has three years of service. The amount shown above

reflects any amounts attributable to benefits provided under a defined benefit plan maintained by his

immediately preceding employer (vesting ratably each month over 14 years) and the amounts

attributable to the company match in Tyco’s defined contribution plans as described above.

Mr. FitzPatrick is 100% vested in his pension benefit. Upon a change of control, Mr. FitzPatrick’s

benefit is paid out immediately.

28 2006 Proxy Statement