ADT 2005 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

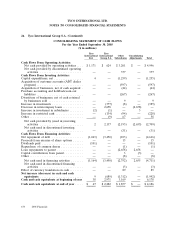

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

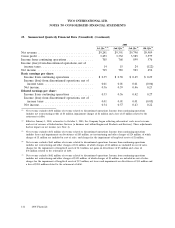

26. Tyco International Group S.A.

TIGSA, a wholly owned subsidiary of the Company, has public debt securities outstanding (see

Note 14), which are fully and unconditionally guaranteed by Tyco. The following tables present

condensed consolidated financial information for Tyco, TIGSA and all other subsidiaries. Condensed

financial information for Tyco and TIGSA on a stand-alone basis is presented using the equity method

of accounting for subsidiaries.

During the fourth quarter of 2005, TIGSA completed a tax-free restructuring involving the

issuance of multiple classes of shares and the distribution of certain investments, intercompany loans

and intercompany receivables to Tyco International Ltd. Since the transactions were entirely among

wholly owned subsidiaries of Tyco there was no impact on the consolidated statements of financial

position, operations or cash flows of the Company. The transactions did, however, result in a decrease

to TIGSA’s investment in subsidiaries and intercompany receivables of a combined $18.4 billion. The

effect of these transactions has been reflected below as if they occurred at the beginning of the earliest

period presented.

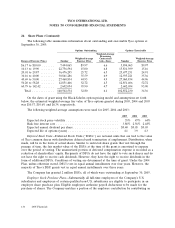

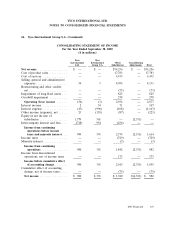

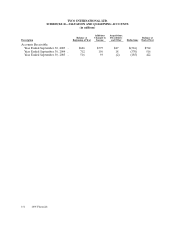

CONSOLIDATING STATEMENT OF INCOME

For the Year Ended September 30, 2005

($ in millions)

Tyco Tyco

International International Other Consolidating

Ltd. Group S.A. Subsidiaries Adjustments Total

Net revenue ................... $ — $ — $39,727 $ — $39,727

Cost of product sales ............ — — 21,192 — 21,192

Cost of services ................ — — 4,767 — 4,767

Selling, general and administrative

expenses .................... 112 63 8,056 — 8,231

Restructuring and other charges, net . . — — 10 — 10

Impairment of long-lived assets ..... — — 6 — 6

(Gains) losses and impairments on

divestitures, net ............... — — (274) — (274)

Operating (loss) income ......... (112) (63) 5,970 — 5,795

Interest income ................ 1 28 94 — 123

Interest expense ................ — (727) (88) — (815)

Other (expense) income, net ....... — (1,013) 102 — (911)

Equity in net income of subsidiaries . . 4,552 2,895 — (7,447) —

Intercompany interest and fees ...... (1,409) 1,715 (306) — —

Income from continuing operations

before income taxes and minority

interest ................... 3,032 2,835 5,772 (7,447) 4,192

Income taxes .................. — (1) (983) — (984)

Minority interest ................ — — (9) — (9)

Income from continuing operations . 3,032 2,834 4,780 (7,447) 3,199

Loss from discontinued operations, net

of income taxes ............... — — (188) — (188)

Income before cumulative effect of

accounting change ........... 3,032 2,834 4,592 (7,447) 3,011

Cumulative effect of accounting

change, net of income taxes ...... — — 21 — 21

Net income .................. $3,032 $ 2,834 $ 4,613 $ (7,447) $ 3,032

2005 Financials 143