ADT 2005 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

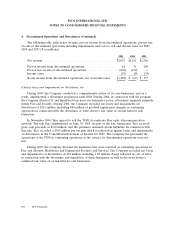

Use of Estimates—The preparation of the Consolidated Financial Statements in conformity with

GAAP requires management to make extensive use of estimates and assumptions that affect the

reported amount of assets and liabilities and disclosure of contingent assets and liabilities and the

reported amounts of revenues and expenses. Significant estimates in these Consolidated Financial

Statements include restructuring and other charges and credits, acquisition liabilities, allowances for

doubtful accounts receivable, estimates of future cash flows associated with asset impairments, useful

lives for depreciation and amortization, loss contingencies, net realizable value of inventories, fair

values of financial instruments, estimated contract revenue and related costs, environmental and legal

liabilities, income taxes and tax valuation reserves, and the determination of discount and other rate

assumptions for pension and postretirement employee benefit expenses. Actual results could differ

materially from these estimates. Changes in estimates are recorded in results of operations in the

period that the event or circumstances giving rise to such changes occur.

Reclassifications—Certain prior year amounts have been reclassified to conform with current year

presentation.

Accounting Pronouncements—In September 2004, the Emerging Issues Task Force (‘‘EITF’’) of the

Financial Accounting Standards Board (‘‘FASB’’) reached a consensus on EITF No. 04-8, ‘‘The Effect of

Contingently Convertible Instruments on Diluted Earnings per Share.’’ This EITF requires that

contingently convertible debt securities with a market price trigger be included in diluted earnings per

share, regardless of whether the market price trigger has been met. EITF No. 04-8 became effective for

Tyco on October 1, 2004 and required retroactive restatement of previously reported earnings per

share. The adoption of this EITF did not impact diluted earnings per share for any period presented.

In November 2004, the FASB issued Statement of Financial Accounting Standards (‘‘SFAS’’)

No. 151, ‘‘Inventory Costs, an amendment of ARB No. 43, Chapter 4.’’ SFAS No. 151 amends

Accounting Research Bulletin (‘‘ARB’’) No. 43, Chapter 4, to clarify that abnormal amounts of idle

facility expense, freight, handling costs and wasted materials (spoilage) should be recognized as current-

period charges. In addition, SFAS No. 151 requires that allocation of fixed production overhead to

inventory be based on the normal capacity of the production facilities. SFAS No. 151 will be effective in

the first quarter of fiscal 2006 for Tyco. The adoption of SFAS No. 151 is not expected to have a

significant impact on the Company’s results of its operations, financial position or cash flows.

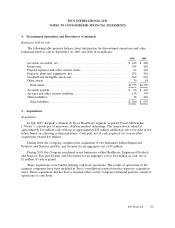

In December 2004, the FASB issued SFAS No. 123R which requires all share-based payments to

employees to be recognized in the financial statements based on their fair values. SFAS No. 123R

replaces SFAS No. 123, ‘‘Accounting for Stock-Based Compensation,’’ and supersedes Accounting

Principles Board Opinion No. 25 (‘‘APB Opinion No. 25’’), ‘‘Accounting for Stock Issued to Employees.’’

Effective October 1, 2005, Tyco adopted the provisions of SFAS No. 123R using the modified

prospective method. Under this method, compensation expense is recorded for all unvested options

over the related vesting period beginning in the quarter of adoption. The Company previously applied

the intrinsic value based method prescribed in APB Opinion No. 25 in accounting for employee stock-

based compensation. Upon adoption of SFAS No. 123R, the Company will recognize stock-based

compensation costs ratably over the service period, which is the earlier of the retirement eligibility date,

if the grant contains provisions such that the award becomes fully vested upon retirement, or the stated

vesting period. For grants issued to retirement eligible employees prior to the adoption of SFAS

No. 123R, the Company will recognize compensation cost over the stated vesting period with

acceleration of any unrecognized compensation cost if and when an employee elects to retire. This

92 2005 Financials