ADT 2005 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

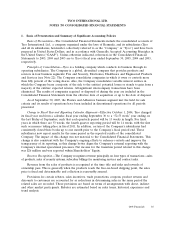

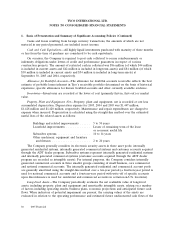

1. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

Product Warranty—The Company generally records estimated product warranty costs at the time of

sale. Manufactured products are warranted against defects in material and workmanship when properly

used for their intended purpose, installed correctly, and appropriately maintained. Generally, product

warranties are implicit in the sale; however, the customer may purchase an extended warranty.

Manufactured equipment is also warranted in the same manner as product warranties. However, in

most instances the warranty is either negotiated in the contract or sold as a separate component.

Warranty period terms range from 90 days (e.g., consumable products) up to 20 years (e.g., power

system batteries.) The warranty liability is determined based on historical information such as past

experience, product failure rates or number of units repaired, estimated cost of material and labor, and

in certain instances estimated property damage.

Environmental Costs—Tyco is subject to laws and regulations relating to protecting the

environment. Tyco provides for expenses associated with environmental remediation obligations when

such amounts are probable and can be reasonably estimated. The Company discounts environmental

liabilities using a risk-free rate of return when the obligation is fixed or reliably determinable. The

impact of the discount on the Consolidated Balance Sheets at September 30, 2005 and 2004 was to

reduce the obligation by $14 million and $20 million, respectively.

Income Taxes—Deferred tax liabilities and assets are recognized for the expected future tax

consequences of events that have been reflected in the Consolidated Financial Statements. Deferred tax

liabilities and assets are determined based on the differences between the book and tax bases of

particular assets and liabilities and operating loss carryforwards, using tax rates in effect for the years in

which the differences are expected to reverse. A valuation allowance is provided to offset deferred tax

assets if, based upon the available evidence, it is more likely than not that some or all of the deferred

tax assets will not be realized.

Insurable Liabilities—The Company records liabilities for its workers’ compensation, product,

general and auto liabilities. The determination of these liabilities and related expenses is dependent on

claims experience. For most of these liabilities, claims incurred but not yet reported are estimated by

utilizing actuarial valuations based upon historical claims experience. Certain insurable liabilities are

discounted using a risk-free rate of return when the obligation is reliably determinable. The impact of

the discount on the Consolidated Balance Sheets at September 30, 2005 and 2004 was to reduce the

obligation by $31 million and $44 million, respectively. The Company maintains captive insurance

companies to manage certain of its insurable liabilities. Additionally, the Company records receivables

from third party insurers when recovery has been determined to be probable.

Financial Instruments—All derivative financial instruments are reported on the Consolidated

Balance Sheets at fair value. Changes in a derivative financial instrument’s fair value are recognized

currently in earnings unless specific hedge criteria are met. At its inception, if the derivative financial

instrument is designated as a fair value hedge, the changes in the fair value of the derivative financial

instrument and the hedged item attributable to the hedged risk are recognized as a charge or credit to

earnings.

Share Premium and Contributed Surplus—In accordance with the Bermuda Companies Act 1981,

when Tyco issues shares for cash at a premium to their par value, the resulting premium is credited to

a share premium account, a non-distributable reserve. When Tyco issues shares in exchange for shares

of another company, the excess of the fair value of the shares acquired over the par value of the shares

issued by Tyco is credited, where applicable, to contributed surplus, which is, subject to certain

conditions, a distributable reserve.

2005 Financials 91