ADT 2005 Annual Report Download - page 128

Download and view the complete annual report

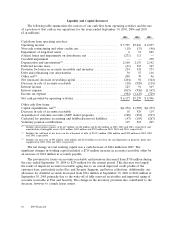

Please find page 128 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sheets were $148 million, of which $79 million are included in accrued and other current liabilities and

$69 million are included in other liabilities.

At September 30, 2005, the acquisition liabilities on our Consolidated Balance Sheets were

$70 million, of which $24 million is included in accrued and other current liabilities and $46 million is

included in other liabilities.

During 2005, the Company sold various businesses for aggregate net proceeds of $295 million of

which $120 million relates to the TGN business. The purchaser of the TGN also assumed certain

liabilities.

In 2005, Surgical, a division of Tyco’s Healthcare segment, acquired Vivant, a developer of

microwave ablation medical technology. The transaction is valued at approximately $66 million cash,

with up to approximately $35 million additional cash to be paid in the future based on the achievement

of certain milestones. Additionally, in November 2005, Tyco’s Healthcare segment acquired a

controlling interest in Floreane Medical Implants, a manufacturer of surgical mesh products. Both of

these transactions strengthen Healthcare’s surgical product portfolio.

We continue to fund capital expenditures to improve the cost structure of our businesses, to invest

in new processes and technology, and to maintain high quality production standards. Capital spending

increased to $1.3 billion in 2005 from $1.0 billion in 2004. The level of capital expenditures is not

expected to exceed depreciation in 2006 and is expected to increase slightly relative to the level of

spending in 2005.

The amount of income taxes paid, net of refunds, during the year was $790 million.

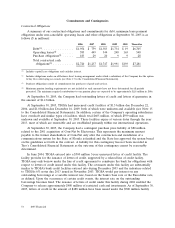

During the first half of 2006, we expect cash outflows of approximately $500 million for resolution

of certain previously accrued legal and legacy matters including a patent dispute in the Healthcare

segment, an SEC enforcement action and certain holdback liabilities.

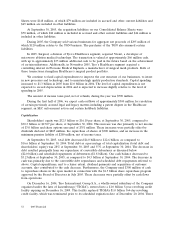

Capitalization

Shareholders’ equity was $32.5 billion or $16.10 per share, at September 30, 2005, compared to

$30.3 billion or $15.07 per share, at September 30, 2004. This increase was due primarily to net income

of $3.0 billion and share options exercised of $351 million. These increases were partially offset by

dividends declared of $805 million, the repurchase of shares of $300 million, and an increase in the

minimum pension liability of $200 million, net of income taxes.

At September 30, 2005, total debt decreased $4.0 billion to $12.6 billion, as compared to

$16.6 billion at September 30, 2004. Total debt as a percentage of total capitalization (total debt and

shareholders’ equity) was 28% at September 30, 2005 and 35% at September 30, 2004. The decrease in

debt resulted principally from our repurchase of convertible debentures as discussed below

($2.0 billion) and scheduled repayments of debentures ($1.8 billion). Our cash balance decreased to

$3.2 billion at September 30, 2005, as compared to $4.5 billion at September 30, 2004. The decrease in

cash was primarily due to the convertible debt repurchases and scheduled debt repayments referred to

above. Capital expenditures, and to a lesser extent, dividend payments and acquisition of customer

accounts, also contributed to the cash decrease. Furthermore, the Company used $300 million of cash

to repurchase shares in the open market in connection with the $1.5 billion share repurchase program

approved by the Board of Directors in July 2005. These decreases were partially offset by cash flows

from operations.

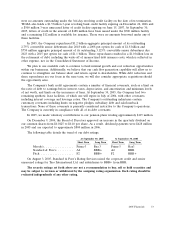

On December 16, 2004, Tyco International Group S.A., a wholly-owned subsidiary of the Company

organized under the laws of Luxembourg (‘‘TIGSA’’), entered into a $1.0 billion 5-year revolving credit

facility expiring on December 16, 2009. This facility replaced TIGSA’s $1.0 billion 364-day revolving

credit facility, which was terminated prior to its scheduled expiration date of December 20, 2004. There

52 2005 Financials