ADT 2005 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

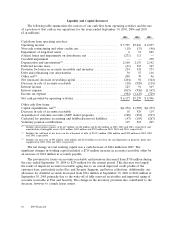

were no amounts outstanding under the 364-day revolving credit facility on the date of its termination.

TIGSA also holds a $1.5 billion 3-year revolving bank credit facility expiring on December 22, 2006 and

a $500 million 3-year unsecured letter of credit facility expiring on June 15, 2007. At September 30,

2005, letters of credit in the amount of $488 million have been issued under the $500 million facility

and a remaining $12 million is available for issuance. There were no amounts borrowed under any of

these facilities.

In 2005, the Company repurchased $1.2 billion aggregate principal amount of its outstanding

2.75% convertible senior debentures due 2018 with a 2008 put option for cash of $1.8 billion and

$750 million aggregate principal amount of its outstanding 3.125% convertible senior debentures due

2023 with a 2015 put option for cash of $1.1 billion. These repurchases resulted in a $1.0 billion loss on

the retirement of debt, including the write-off of unamortized debt issuance costs, which is reflected in

other expense, net, in the Consolidated Statement of Income.

We plan to use available cash to continue to fund internal growth and cost reduction opportunities

within our businesses. Additionally, we believe that our cash flow generation capability will allow us to

continue to strengthen our balance sheet and return capital to shareholders. While debt reduction and

share repurchases are our focus in the near term, we will also consider appropriate acquisitions should

the opportunity arise.

The Company’s bank credit agreements contain a number of financial covenants, such as a limit on

the ratio of debt to earnings before interest, taxes, depreciation, and amortization and minimum levels

of net worth, and limits on the incurrence of liens. At September 30, 2005, the Company had two

remaining synthetic lease facilities, of which one will expire in July of 2006, with other covenants,

including interest coverage and leverage ratios. The Company’s outstanding indentures contain

customary covenants including limits on negative pledges, subsidiary debt and sale/leaseback

transactions. None of these covenants is presently considered restrictive to the Company’s operations.

The Company is currently in compliance with all of its debt covenants.

In 2005, we made voluntary contributions to our pension plans totaling approximately $115 million.

On December 9, 2004, the Board of Directors approved an increase in the quarterly dividend on

our common shares from $0.0125 to $0.10 per share. As a result, dividend payments were $628 million

in 2005 and are expected to approximate $800 million in 2006.

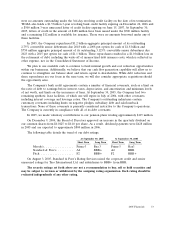

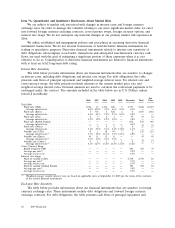

The following table details the trend of our debt ratings:

At September 30, 2005 At September 30, 2004

Short Term Long Term Short Term Long Term

Moody’s ................. Prime-3 Baa 3 Prime-3 Baa3

Standard & Poor’s ......... A2 BBB+ A2 BBB

Fitch ................... F2 BBB+ F2 BBB+

On August 3, 2005, Standard & Poor’s Rating Services raised the corporate credit and senior

unsecured ratings for Tyco International Ltd. and subsidiaries to BBB+ from BBB.

The security ratings set forth above are not a recommendation to buy, sell or hold securities and

may be subject to revision or withdrawal by the assigning rating organization. Each rating should be

evaluated independently of any other rating.

2005 Financials 53