ADT 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interest Income and Expense

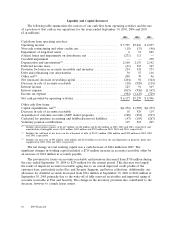

Interest income was $123 million in 2005, as compared to $91 million and $107 million in 2004 and

2003, respectively.

Interest expense was $815 million in 2005, as compared to $956 million in 2004 and $1,147 million

in 2003. The decrease in interest expense in 2005 is primarily driven by lower debt balances, partially

offset by the impact of higher interest rates on our interest rate swap program compared to the same

period in the prior year. The decrease in interest expense in 2004 over 2003 is primarily the result of a

lower average debt balance in 2004 and the favorable impact of interest rate swap agreements executed

during the year. The weighted-average rates of interest on total debt outstanding during 2005, 2004 and

2003 were 5.6%, 5.2% and 4.9%, respectively.

Other Expense, Net

On September 12, 2002, indictments were filed in the Supreme Court of the State of New York

against Mr. L. Dennis Kozlowski, our former Chairman and Chief Executive Officer, and Mr. Mark H.

Swartz, our former Chief Financial Officer and director (together, the ‘‘Defendants’’), alleging

enterprise corruption, fraud, conspiracy, grand larceny, falsifying certain business records and other

crimes. On June 17, 2005, a jury convicted the Defendants on 22 of 23 counts in the indictment. On

September 19, 2005, the Defendants were sentenced in New York State Supreme Court to serve eight

and one third years to twenty five years in prison and to make joint restitution to the Company in the

amount of $134 million, resulting from the larceny convictions. The Court ordered the restitution

payment to be made by no later than one year from the date of sentencing.

The restitution award is comprised of $109 million of previously expensed compensation made to

the defendants and reported as ‘‘Other expense, net’’ in prior years and $25 million related to a loan

receivable from one of the Defendants which had been and remains reflected in the Company’s

consolidated financial statements as a receivable. In the fourth quarter of 2005, the Company

recognized $109 million of income, included in ‘‘Other expense, net’’ in the accompanying Consolidated

Statement of Income. The Defendants have filed a notice of appeal of the convictions. The Company

considered the collectibility of the restitution award and assessed the likelihood of the Defendants’

success upon appeal of the larceny convictions, which, if successful, could result in a change to the

restitution order, and has concluded that receipt of the restitution award is probable.

During 2005, other expense, net also included losses related to the repurchase of outstanding

convertible debt prior to its scheduled maturity of $1,013 million. See Note 14 to the Consolidated

Financial Statements for details regarding debt repurchases.

During 2004, other expense, net consisted primarily of a net loss on the retirement of debt. The

Company repurchased $303 million of its 7.2% notes due 2008 for cash of $341 million, which resulted

in a $38 million loss, including unamortized debt issuance costs, on the retirement of debt.

Additionally, the Company repurchased $517 million of its outstanding 2.75% convertible senior

debentures with a 2008 put option. The total purchase price paid was $750 million and the repurchase

resulted in a $241 million loss on the retirement of debt, including the write-off of unamortized debt

issuance costs.

During 2003, other expense, net consisted primarily of a net loss on the retirement of debt of

$128 million and a loss relating to the write-down of various investments of $87 million. The value of

the investments were reduced when it became evident that the declines in the fair value of the

investments were other than temporary, predominately due to the continuing depressed economic

conditions, specifically within the telecommunications industry.

2005 Financials 43