ADT 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

program. As of September 30, 2005, we have repurchased 10.5 million of our common shares for

$300 million. In the two weeks following the end of the fourth quarter of 2005, we have repurchased an

additional 7.9 million of our common shares for $216 million. As a result of this program, we anticipate

spending a total of approximately $2 billion through the second quarter of 2006 for these repurchases.

During the first quarter of 2005, we announced a substantial increase in our quarterly dividend

from $0.0125 per share to $0.10 per share. As a result, dividend payments for 2005 increased to

$628 million from $100 million in the comparable prior year period.

References to Tyco are to the Company’s continuing operations. Prior year amounts have been

reclassified to exclude the results of discontinued operations and to comparatively reflect changes in the

Company’s segment reporting. The operating results of the TGN are presented within Corporate and

Other through the date of its disposal in the third quarter of 2005. Information for 2003 has been

reclassified to reflect the transfer of Tyco’s Precision Interconnect business from Healthcare to

Electronics in 2004.

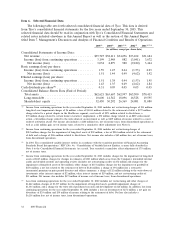

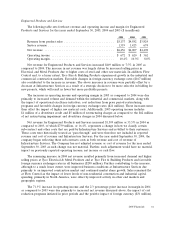

Operating Results

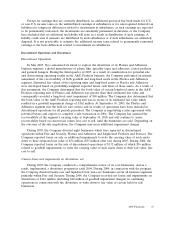

The following table details net revenue and earnings for the years ended September 30, 2005, 2004

and 2003 ($ in millions):

2005 2004 2003

Revenue from product sales ............................. $31,955 $30,337 $27,114

Service revenue ...................................... 7,772 8,074 7,142

Net revenue ......................................... $39,727 $38,411 $34,256

Operating income ..................................... $ 5,795 $ 5,236 $ 2,877

Interest income ....................................... 123 91 107

Interest expense ...................................... (815) (956) (1,147)

Other expense, net .................................... (911) (286) (223)

Income from continuing operations before income taxes and

minority interest .................................... 4,192 4,085 1,614

Income taxes ........................................ (984) (1,123) (729)

Minority interest ...................................... (9) (14) (3)

Income from continuing operations ........................ 3,199 2,948 882

(Loss) income from discontinued operations, net of income taxes . . (188) (69) 173

Income before cumulative effect of accounting change ........... 3,011 2,879 1,055

Cumulative effect of accounting change, net of income taxes ...... 21 — (75)

Net income .......................................... $ 3,032 $ 2,879 $ 980

Net revenue increased $1.3 billion, or 3.4%, for 2005 as compared to 2004, which resulted from

growth in all segments. Foreign currency exchange rates favorably affected 2005 by $876 million while

the impact of divestitures and acquisitions negatively impacted the period by $689 million.

Operating income increased $559 million, or 10.7%, for 2005 while operating margin increased

1.0 percentage point to 14.6%. 2005 was favorably impacted by the gain on the sale of the TGN

business ($303 million). In addition, the year was unfavorably impacted by charges related to an

adverse decision by the United States Court of Appeals for the Federal Circuit on a patent dispute in

the Healthcare segment ($277 million), a charge related to an SEC enforcement action of $50 million

and a charge relating to former executives’ employment of $70 million. Foreign currency exchange rates

favorably affected operating income by $142 million.

2005 Financials 35