ADT 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

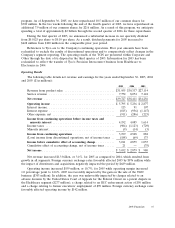

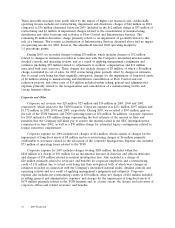

adjustments to liabilities such as workers’ compensation, professional fees, and environmental exposure,

a charge of $98 million primarily due to adjusting allowances for doubtful accounts and slow and

non-moving inventory, as well as a write-off of subscriber systems, charges of $34 million for other

adjustments primarily related to deferred commissions, and charges of $6 million related to reconciling

items) recorded in connection with the Company’s intensified internal audits, detailed controls and

operating reviews performed during the year. Also included within the $512 million are impairment

charges of $143 million primarily related to the impairment of intangible assets associated with the

ADT dealer program mostly as a result of increased attrition rates, and to the impairment of property,

plant and equipment of subscriber systems and other fixed assets; net restructuring and other charges

of $10 million, of which charges of $4 million are included in cost of sales and $3 million is for the

write-off of non-current assets, related to streamlining the business; and other charges of $93 million, of

which $34 million is included in cost of sales and $59 million is included in selling, general and

administrative expenses, primarily related to uncollectible receivables, product warranty and the

dismantlement of customers’ ADT security systems. Included within the $143 million impairment

charge and the $10 million net restructuring charge is a charge of $10 million and a credit of

$2 million, respectively, also related to changes in estimates recorded during the quarter ended

March 31, 2003.

Electronics

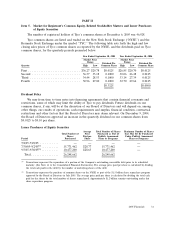

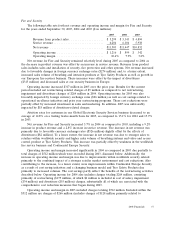

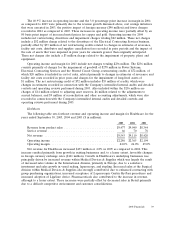

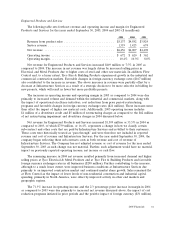

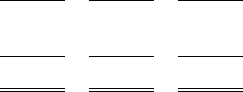

The following table sets forth net revenue and operating income and margin for Electronics for the

years ended September 30, 2005, 2004 and 2003 ($ in millions):

2005 2004 2003

Revenue from product sales .................... $12,042 $11,372 $10,052

Service revenue ............................. 154 450 440

Net revenue ............................... $12,196 $11,822 $10,492

Operating income ........................... $ 1,852 $ 1,749 $ 1,241

Operating margin ........................... 15.2% 14.8% 11.8%

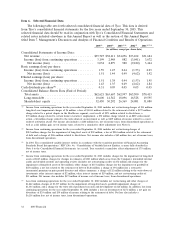

Net revenue for Electronics increased $374 million or 3.2% in 2005 as compared to 2004, including

a 5.9% increase in product revenue. The increase in net revenue was driven primarily by sales to the

automotive, aerospace and defense, consumer electronics, power utilities, communications equipment

manufacturing, and communication service markets. In addition, revenue increased substantially due to

favorable changes in foreign currency exchange rates ($294 million). These increases were partially

offset by the impact of the divestiture of the Electrical Contracting Services business ($353 million).

Operating income and operating margin for 2005 increased as compared to 2004 due primarily to

increased sales volume, cost savings initiatives and favorable changes in foreign currency exchange rates

($57 million). These increases were partially offset by an 80 basis point impact of increased commodity

costs. Additionally, operating income for 2005 included net restructuring and other credits of

$5 million, as compared to net restructuring, divestiture and impairment charges of $22 million in 2004,

discussed below.

Net revenue for Electronics increased 12.7% in 2004 as compared to 2003, including a 13.1%

increase in product revenue and a 2.3% increase in service revenue. The increase in net revenue was

primarily a result of growth in existing businesses, specifically, the automotive, computer, consumer

electronics, communications and industrial and commercial markets. This growth was partially offset by

a decrease in sales of Power Systems products in North America and in our Electrical Contracting

Services, which was divested in September 2004. Additionally, favorable changes in foreign currency

rates ($560 million) contributed to the increase in net revenue.

38 2005 Financials