ADT 2005 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

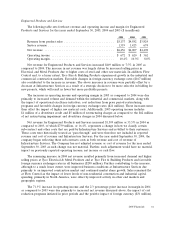

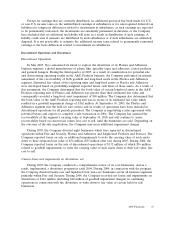

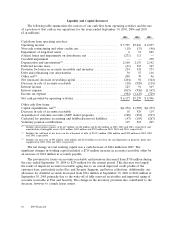

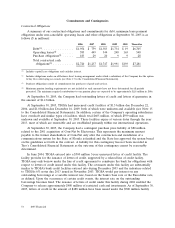

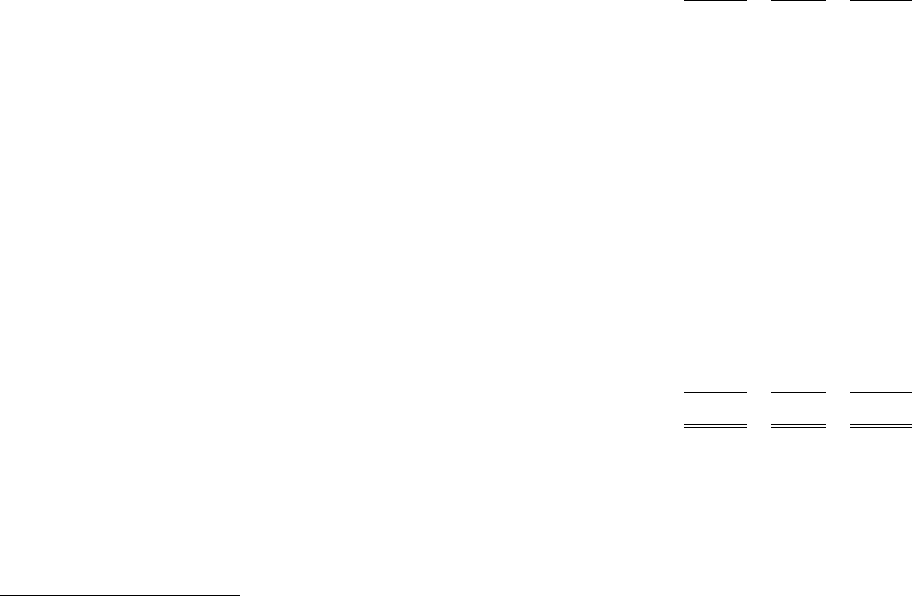

Liquidity and Capital Resources

The following table summarizes the sources of our cash flow from operating activities and the use

of a portion of that cash in our operations for the years ended September 30, 2005, 2004 and 2003

($ in millions):

2005 2004 2003

Cash flows from operating activities:

Operating income .......................................... $5,795 $5,236 $ 2,877

Non-cash restructuring and other credits, net ...................... (18) (33) (46)

Impairment of long-lived assets ................................ 6 51 825

(Gains) losses and impairments on divestitures, net ................. (271) 111 —

Goodwill impairment ....................................... — — 278

Depreciation and amortization(1) ............................... 2,100 2,119 2,142

Deferred income taxes ...................................... (41) 167 367

Provision for losses on accounts receivable and inventory ............. 234 318 573

Debt and refinancing cost amortization .......................... 30 55 116

Other, net(2) .............................................. 200 78 96

Net (increase) decrease in working capital ........................ (204) 94 (344)

Decrease in sale of accounts receivable .......................... (18) (929) (119)

Interest income ........................................... 123 91 107

Interest expense ........................................... (815) (956) (1,147)

Income tax expense ........................................ (984) (1,123) (729)

Net cash provided by operating activities ......................... $6,137 $5,279 $ 4,996

Other cash flow items:

Capital expenditures, net(3) ................................... $(1,272) $ (987) $(1,255)

Decrease in sale of accounts receivable .......................... 18 929 119

Acquisition of customer accounts (ADT dealer program) ............. (328) (254) (597)

Cash paid for purchase accounting and holdback/earn-out liabilities ...... (47) (105) (267)

Voluntary pension contributions ................................ 115 567 205

(1) Includes depreciation expense of $1,447 million, $1,428 million and $1,420 million in 2005, 2004 and 2003, respectively and

amortization of intangible assets ($653 million, $691 million and $722 million in 2005, 2004 and 2003, respectively).

(2) Includes the add-back of net losses on the retirement of debt of $1,013 million, $284 million and $128 million in 2005, 2004

and 2003, respectively.

(3) Includes net proceeds of $94 million, $141 million and $124 million received for the sale/disposition of property, plant and

equipment in 2005, 2004 and 2003, respectively.

The net change in total working capital was a cash decrease of $204 million in 2005. The

significant changes in working capital included a $714 million increase in accounts receivable offset by

an increase of $424 million in accounts payable.

The provision for losses on accounts receivable and inventory decreased from $318 million during

the year ended September 30, 2004 to $234 million for the current period. This decrease was largely

the result of improved accounts receivable aging due to an overall improved credit profile of the

customer base, particularly in the Fire and Security Segment, and better collections. Additionally, our

allowance for doubtful accounts decreased from $516 million at September 30, 2004 to $422 million at

September 30, 2005 primarily due to the write-off of fully reserved receivables and improved aging of

accounts receivable at Fire and Security. The change in the inventory provision also contributed to the

decrease, however to a much lesser extent.

50 2005 Financials