ADT 2005 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.These favorable increases were partly offset by the impact of higher raw material costs. Additionally,

operating income includes net restructuring, impairment and divestiture charges of $62 million in 2004

compared to $56 million (discussed below) in 2003. Included in the $62 million charge is $53 million of

restructuring and $4 million of impairment charges related to the consolidation of manufacturing,

distribution and office locations and activities at Flow Control and Infrastructure Services. The

remaining $5 million divestiture charge primarily relates to an impairment of goodwill related to the

sale of a business. The revenue reclassification at Infrastructure Services discussed above had no impact

on operating income for 2004; however, this adjustment lowered 2004 operating margin by

1.5 percentage points.

During 2003, we recorded charges totaling $56 million, which includes charges of $32 million

related to changes in estimates recorded in connection with the Company’s intensified internal audits,

detailed controls and operating reviews, and as a result of applying management’s judgments and

estimates (including $19 million related to adjustments to workers’ compensation and $13 million

associated with asset reserves). These charges also include charges of $8 million, of which a $6 million

charge is included in cost of sales, for 2003 restructuring plans partially offset by changes in estimates

due to actual costs being less than originally anticipated, charges for the impairment of long-lived assets

of $2 million relating to manufacturing and distribution consolidation at Flow Control and cost

reduction projects, and other costs of $14 million included within selling, general and administrative

expenses primarily related to the reorganization and consolidation of a manufacturing facility and

certain business offices.

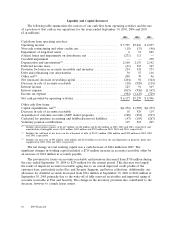

Corporate and Other

Corporate net revenue was $29 million, $25 million and $14 million in 2005, 2004 and 2003,

respectively, which related to the TGN business. Corporate expense was $231 million, $397 million and

$1,172 million in 2005, 2004 and 2003, respectively. During 2005, we recorded a $303 million gain on

the sale of the TGN business and TGN operating losses of $54 million. In addition, corporate expenses

for 2005 included a $50 million charge representing the best estimate of the amount in fines and

penalties that the Company will likely pay to resolve the matters raised in the SEC investigation that

commenced in June 2002, as well as a $70 million charge for estimated legacy contingencies related to

former executives’ employment.

Corporate expense for 2004 includes net charges of $14 million, which consists of charges for the

impairment of long-lived assets of $8 million and net restructuring charges of $6 million primarily

attributable to severance related to the relocation of the corporate headquarters. Expense also included

$73 million of operating losses related to the TGN.

Corporate expense for 2003 includes charges totaling $824 million. Included within the

$824 million is a charge of $91 million for an incremental increase in directors and officers insurance

and charges of $39 million related to internal investigation fees. Also included is a charge of

$20 million primarily related to severance and benefits for corporate employees and a restructuring

credit of $11 million due to actual costs being less than anticipated, both of which were changes in

estimates recorded in connection with the Company’s intensified internal audits, detailed controls and

operating reviews and as a result of applying management’s judgments and estimates. Corporate

expense also includes net restructuring credits of $10 million, other net charges of $16 million included

in selling, general and administrative expenses, and charges for the impairment of long-lived assets of

$679 million primarily related to the TGN business and, to a lesser extent, the closure and relocation of

corporate offices and related severance and benefits.

42 2005 Financials