ADT 2005 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

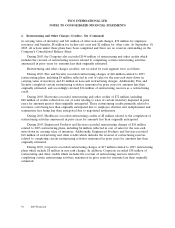

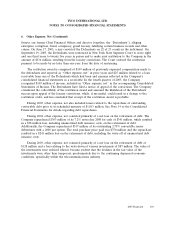

2. Restructuring and Other Charges (Credits), Net (Continued)

2002 Charges and Credits

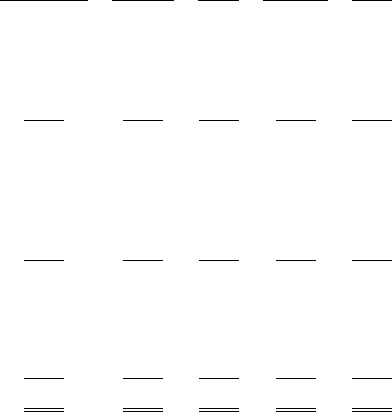

Activity for the Company’s 2002 restructuring reserves is summarized as follows ($ in millions):

Employee Facilities

Severance Exit Non-cash

and Benefits Costs Other Charges Total

Balance at September 30, 2002 ................... $168 $181 $419 $115 $883

Utilization ................................. (120) (58) (265) — (443)

Credits .................................... (18) 7 (48) — (59)

Transfers/reclassifications ....................... — — (23) (115) (138)

Currency translation .......................... 5 (1) (2) — 2

Balance at September 30, 2003 ................... 35 129 81 — 245

Utilization ................................. (16) (43) (27) — (86)

Credits .................................... (11) (2) 2 — (11)

Transfers/reclassifications ....................... — (2) — — (2)

Assets held for sale ........................... — (31) (53) — (84)

Currency translation .......................... 1 — — — 1

Balance at September 30, 2004 ................... 9 51 3 — 63

Charges ................................... — 4 2 — 6

Utilization ................................. (7) (16) 1 — (22)

Credits .................................... (1) 1 (5) — (5)

Transfer from held for sale ..................... — 39 — — 39

Balance at September 30, 2005 ................... $ 1 $ 79 $ 1 $ — $ 81

During 2002, the Company approved and announced to employees various plans to exit 193

facilities primarily in the United States, Europe and Latin America which includes the restructuring of

certain operations within the Tyco Submarine Telecommunications business. These plans included the

termination of approximately 13,800 employees and other related exit costs. These decisions resulted in

restructuring charges totaling $1,911 million, including $635 million in cost of sales for the non-cash

write-down in carrying value of inventory and $115 million recorded in selling, general and

administrative expenses for an increase to the bad debt provision. The balance of these charges

includes $377 million for employee severance and benefits, $274 million for facility exit costs, and

$511 million for other related costs. Through September 30, 2005, a total of $284 million, $198 million

and $445 million related to employee severance and benefits, facilities exit costs and other, respectively

have been expended related to these plans. As of September 30, 2005, the Company’s remaining

obligations for the 2002 actions primarily related to long-term non-cancelable lease obligations for

facilities within the Electronics segment totaling $79 million.

2005 Financials 97