ADT 2005 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

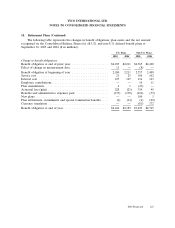

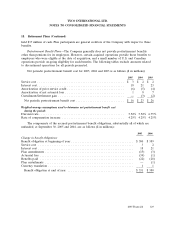

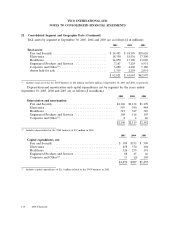

18. Retirement Plans (Continued)

respectively, at September 30, 2005 and $2,167 million and $1,957 million, respectively, at

September 30, 2004.

The accumulated benefit obligation and fair value of plan assets for non-U.S. pension plans with

accumulated benefit obligations in excess of plan assets were $2,733 million and $1,792 million,

respectively, at September 30, 2005 and $2,209 million and $1,342 million, respectively, at

September 30, 2004.

The Company also participates in a number of multi-employer defined benefit plans on behalf of

certain employees. Pension expense related to multi-employer plans was $15 million, $13 million and

$14 million in 2005, 2004 and 2003, respectively.

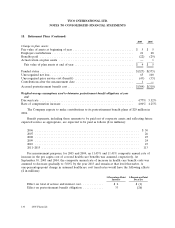

Executive Retirement Arrangements—Messrs. Kozlowski and Swartz participated in individual

Executive Retirement Arrangements maintained by Tyco (the ‘‘ERA’’). Under the ERA,

Messrs. Kozlowski and Swartz would have fixed lifetime benefits commencing at their normal

retirement age of 65. The Company’s accrued benefit obligations for Messrs. Kozlowski and Swartz as

of September 30, 2005 were $62 million and $32 million, respectively. The Company’s accrued benefit

obligations for Messrs. Kozlowski and Swartz as of September 30, 2004 were $58 million and

$30 million, respectively. Retirement benefits are available at earlier ages and alternative forms of

benefits can be elected. Any such variations would be actuarially equivalent to the fixed lifetime benefit

starting at age 65. Amounts owed to Messrs. Kozlowski and Swartz under the ERA are in dispute by

the Company. For further information, see Note 13.

Defined Contribution Retirement Plans—The Company maintains several defined contribution

retirement plans, which include 401(k) matching programs, as well as qualified and nonqualified profit

sharing and share bonus retirement plans. Expense for the defined contribution plans is computed as a

percentage of participants’ compensation and was $180 million, $168 million and $179 million for 2005,

2004 and 2003, respectively. The Company also maintains an unfunded Supplemental Executive

Retirement Plan (‘‘SERP’’). This plan is nonqualified and restores the employer match that certain

employees lose due to IRS limits on eligible compensation under the defined contribution plans.

Expense related to the SERP was $3 million in 2005 and 2004 and $4 million in 2003.

Deferred Compensation Plans—The Company has nonqualified deferred compensation plans, which

permit eligible employees to defer a portion of their compensation. A record keeping account is set up

for each participant and the participant chooses from a variety of measurement funds for the deemed

investment of their accounts. The measurement funds correspond to a number of funds in the

Company’s 401(k) plans and the account balance fluctuates with the investment returns on those funds.

Deferred compensation expense was $4 million, $15 million and $17 million in 2005, 2004 and 2003,

respectively. Total deferred compensation liabilities were $172 million and $156 million at

September 30, 2005 and 2004, respectively.

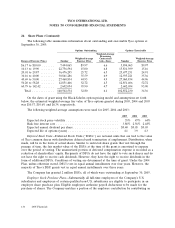

Rabbi Trust—The Company has established a rabbi trust, the assets of which may be used to pay

non-qualified plan benefits. The trust primarily holds corporate-owned life insurance policies. The rabbi

trust assets, which are consolidated, are subject to the claims of the Company’s creditors in the event of

the Company’s insolvency. The cash surrender value of these policies, net of outstanding loans,

included in other noncurrent assets on the Consolidated Balance Sheets was $218 million and

$210 million at September 30, 2005 and 2004, respectively. At September 30, 2005, the rabbi trust also

128 2005 Financials