ADT 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

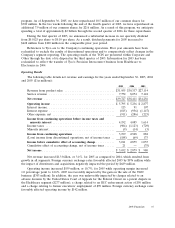

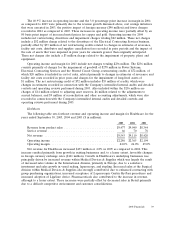

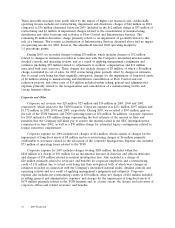

The 40.9% increase in operating income and the 3.0 percentage point increase in margin in 2004

as compared to 2003 were primarily due to the revenue growth discussed above, cost savings initiatives

that were executed in 2003, the positive impact of foreign currency ($90 million) and fewer charges

recorded in 2004 as compared to 2003. These increases in operating income were partially offset by an

80 basis point impact of increased metal prices for copper and gold. Operating income for 2004

includes net restructuring, divestiture and impairment charges totaling $22 million. These net charges

include a $52 million charge related to the divestiture of the Electrical Contracting Services business,

partially offset by $33 million of net restructuring credits related to changes in estimates of severance,

facility exit costs, distributor and supplier cancellation fees recorded in prior periods and the impact of

the sale of assets that were impaired in prior years for amounts greater than originally anticipated.

These net charges also include a $3 million charge related to the impairment of property, plant, and

equipment.

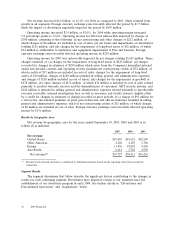

Operating income and margin for 2003 include net charges totaling $236 million. The $236 million

consists primarily of charges for the impairment of goodwill of $278 million in Power Systems,

Electrical Contracting Services and the Printed Circuit Group, restructuring credits of $72 million, of

which $20 million is included in cost of sales, related primarily to changes in estimates of severance and

facility exit costs recorded in prior years and charges for the impairment of long-lived assets of

$1 million. The net restructuring credit of $72 million includes $55 million of credits, which were

changes in estimates recorded in connection with the Company’s intensified internal audits and detailed

controls and operating reviews performed during 2003. Also included within the $236 million are

charges of $14 million related to adjusting asset reserves, $6 million related to the adjustments to

accrual balances, and $9 million of reconciliation and other accounting adjustments, which were also

recorded in connection with the Company’s intensified internal audits and detailed controls and

operating reviews performed during 2003.

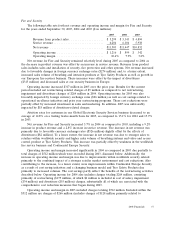

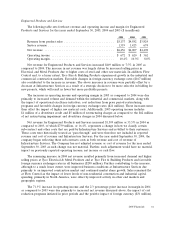

Healthcare

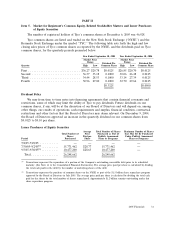

The following table sets forth net revenue and operating income and margin for Healthcare for the

years ended September 30, 2005, 2004 and 2003 ($ in millions):

2005 2004 2003

Revenue from product sales ............................. $9,477 $9,040 $8,344

Service revenue ...................................... 66 70 76

Net revenue ........................................ $9,543 $9,110 $8,420

Operating income .................................... $2,286 $2,365 $2,104

Operating margin ..................................... 24.0% 26.0% 25.0%

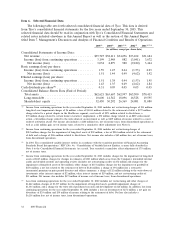

Net revenue for Healthcare increased $433 million or 4.8% in 2005 as compared to 2004. This

increase resulted primarily from growth in existing businesses and, to a lesser extent, favorable changes

in foreign currency exchange rates ($141 million). Growth in Healthcare’s underlying businesses was

principally driven by increased revenue within Medical Devices & Supplies which was largely the result

of increased sales volume in the International division, primarily in Europe, due to a salesforce

investment and sales growth in vessel sealing, laparoscopy, and stapling. Increased sales at the Surgical

division within Medical Devices & Supplies also strongly contributed, due to enhanced contracting with

group purchasing organizations, increased acceptance of Laparoscopic Gastric By-Pass procedures and

increased adoption of LigaSure device. Pharmaceuticals also contributed to the increase in revenue,

although to a lesser extent. These increases were partially offset by decreased sales in Retail primarily

due to a difficult competitive environment and customer consolidations.

2005 Financials 39