ADT 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in DSUs include the value of dividend equivalents. The value noted for Dr. Gromer does not include the value of shares he

earned as part of his fiscal 2003 annual incentive plan, which is included in the Bonus column.

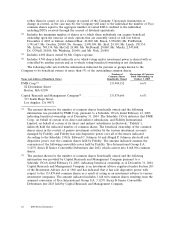

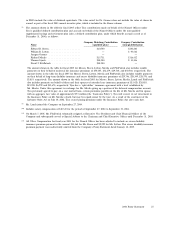

(8) The amounts shown in the table for fiscal 2005 reflect Tyco contributions made on behalf of the Named Officers under

Tyco’s qualified defined contribution plan and accruals on behalf of the Named Officers under the non-qualified

supplemental savings and retirement plan (also a defined contribution plan, under which benefit accruals ceased as of

December 31, 2004), as follows:

Company Matching Contribution Company Contribution

Name (qualified plan) (non-qualified plan)

Edward D. Breen .................... $10,500 $230,260

William B. Lytton .................... — $93,562

Juergen Gromer .................... — —

Richard Meelia ..................... $15,731 $116,432

Thomas Lynch ...................... $10,500 $ 13,306

David J. FitzPatrick .................. $10,500 —

The amount shown in the table for fiscal 2005 for Messrs. Breen, Lytton, Meelia and FitzPatrick also includes taxable

payments on their behalf of universal life insurance premiums of $50,405, $32,279, $29,760, and $30,560, respectively. The

amount shown in the table for fiscal 2005 for Messrs. Breen, Lytton, Meelia and FitzPatrick also includes taxable payments

on their behalf of long-term disability insurance and excess disability insurance premiums of $29,746, $20,349, $20,570, and

$5,819, respectively. The amount shown in the table for fiscal 2005 for Messrs. Breen, Lytton, Meelia, Lynch and FitzPatrick

also includes payments on behalf of them and their spouses of extended care insurance premiums of $15,428, $20,855,

$15,924, $6,992 and $15,678, respectively. Tyco has a ‘‘split dollar’’ insurance agreement with a trust established by

Mr. Meelia. Under this agreement, in exchange for Mr. Meelia giving up a portion of his deferred compensation account,

Tyco previously agreed to pay, on a cost neutral basis, certain premiums payable on the life of Mr. Meelia and his spouse,

with an aggregate face value of approximately $9.5 million (the ‘‘Insurance Policy’’). Tyco will recover its net investment in

the Insurance Policy on Mr. Meelia’s death, but may be repaid sooner by the trust. As a result of the enactment of the

Sarbanes-Oxley Act on July 30, 2002, Tyco ceased paying premiums under the Insurance Policy due after such date.

(9) Mr. Lynch joined the Company on September 27, 2004.

(10) Includes salary compensation of $10,345 for the period of September 27, 2004 to September 30, 2004.

(11) On March 7, 2005, Mr. FitzPatrick voluntarily resigned as Executive Vice President and Chief Financial Officer of the

Company and subsequently served as Special Advisor to the Chairman and Chief Executive Officer until December 31, 2005.

(12) All Other Compensation for fiscal year 2004 for the Named Officer has been adjusted to include an excess disability

insurance premium payment in the amount $14,168 for Mr. Breen and $2,229 for Mr. Lytton. This excess disability insurance

premium payment was inadvertently omitted from the Company’s Proxy Statement dated January 12, 2005.

2006 Proxy Statement 25