ADT 2005 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

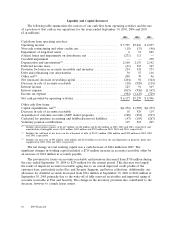

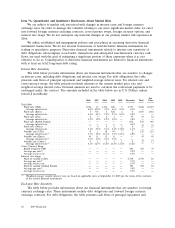

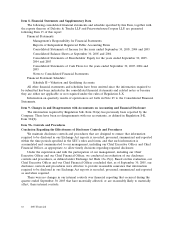

Commitments and Contingencies

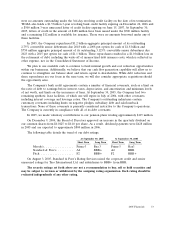

Contractual Obligations

A summary of our contractual obligations and commitments for debt, minimum lease payment

obligations under non-cancelable operating leases and other obligations at September 30, 2005 is as

follows ($ in millions):

2006 2007 2008 2009 2010 Thereafter

Debt(1) .................. $1,954 $ 759 $1,383 $1,734 $ 19 $6,705

Operating leases(2) ......... 583 449 344 248 165 548

Purchase obligations(3) ...... 183 29 20 9 9 28

Total contractual cash

obligations(4) ............ $2,720 $1,237 $1,747 $1,991 $193 $7,281

(1) Includes capital lease obligations and excludes interest.

(2) Includes obligations under an off-balance sheet leasing arrangement under which a subsidiary of the Company has the option

to buy five cable laying sea vessels (see Note 17 to the Consolidated Financial Statements).

(3) Purchase obligations consist of commitments for purchases of good and services.

(4) Minimum pension funding requirements are not included as such amounts have not been determined for all periods

presented. The minimum required contributions to our pension plans are expected to be approximately $118 million in 2006.

At September 30, 2005, the Company had outstanding letters of credit and letters of guarantee in

the amount of $1.4 billion.

At September 30, 2005, TIGSA had unsecured credit facilities of $1.5 billion due December 22,

2006, and $1.0 billion due December 16, 2009, both of which were undrawn and available (see Note 15

to the Consolidated Financial Statements). In addition, certain of the Company’s operating subsidiaries

have overdraft and similar types of facilities, which total $605 million, of which $599 million was

undrawn and available at September 30, 2005. These facilities expire at various dates through the year

2013, most of which are renewable and are established primarily within our international operations.

At September 30, 2005, the Company had a contingent purchase price liability of $80 million

related to the 2001 acquisition of Com-Net by Electronics. This represents the maximum amount

payable to the former shareholders of Com-Net only after the construction and installation of a

communications system for the State of Florida is finished and the State has approved the system based

on the guidelines set forth in the contract. A liability for this contingency has not been recorded in

Tyco’s Consolidated Financial Statements as the outcome of this contingency cannot be reasonably

determined.

In June 2004, TIGSA entered into a $500 million 3-year unsecured letter of credit facility. The

facility provides for the issuance of letters of credit, supported by a related line of credit facility.

TIGSA may only borrow under the line of credit agreement to reimburse the bank for obligations with

respect to letters of credit issued under this facility. The covenants under this facility are substantially

similar to TIGSA’s bank credit facilities entered into during December 2003 and the indenture related

to TIGSA’s 6% notes due 2013 issued in November 2003. TIGSA would pay interest on any

outstanding borrowings at a variable interest rate, based on the bank’s base rate or the Eurodollar rate,

as defined. Upon the occurrence of certain credit events, the interest rate on the outstanding

borrowings becomes fixed. The issuance of letters of credit under this facility during 2004 enabled the

Company to release approximately $480 million of restricted cash and investments. As of September 30,

2005, letters of credit in the amount of $488 million have been issued under the $500 million facility

54 2005 Financials