ADT 2005 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

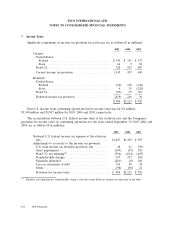

7. Income Taxes (Continued)

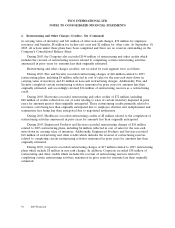

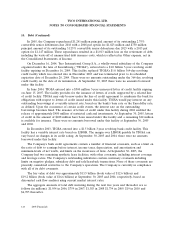

Deferred income taxes result from temporary differences between the amount of assets and

liabilities recognized for financial reporting and tax purposes. The components of the net deferred

income tax asset at September 30, 2005 and 2004 are as follows ($ in millions):

2005 2004

Deferred tax assets:

Accrued liabilities and reserves ......................... $1,424 $1,565

Tax loss and credit carryforwards ........................ 3,165 2,846

Inventories ........................................ 149 201

Postretirement benefits ............................... 582 496

Deferred revenue ................................... 225 254

Other ........................................... 500 329

6,045 5,691

Deferred tax liabilities:

Property, plant and equipment ......................... (516) (569)

Intangibles assets ................................... (755) (383)

Other ........................................... (231) (262)

(1,502) (1,214)

Net deferred tax asset before valuation allowance ............. 4,543 4,477

Valuation allowance ................................... (1,867) (1,967)

Net deferred tax asset ................................ $2,676 $2,510

At September 30, 2005, the Company had $3,967 million of net operating loss carryforwards in

certain non-U.S. jurisdictions. Of these, $2,890 million have no expiration, and the remaining

$1,077 million will expire in future years through 2015. In the U.S., there were approximately

$4,162 million of federal and $5,128 million of state net operating loss carryforwards at September 30,

2005, which will expire in future years through 2025.

The valuation allowance for deferred tax assets of $1,867 million and $1,967 million at

September 30, 2005 and 2004, respectively, relates principally to the uncertainty of the utilization of

certain deferred tax assets, primarily tax loss and credit carryforwards in various jurisdictions. The

Company believes that it will generate sufficient future taxable income to realize the tax benefits

related to the remaining net deferred tax assets. The valuation allowance was calculated in accordance

with the provisions of SFAS No. 109, ‘‘Accounting for Income Taxes,’’ which requires that a valuation

allowance be established or maintained when it is ‘‘more likely than not’’ that all or a portion of

deferred tax assets will not be realized. At September 30, 2005, approximately $162 million of the

valuation allowance will ultimately reduce goodwill if the net operating losses are utilized.

The Company and its subsidiaries’ income tax returns are periodically examined by various tax

authorities. In connection with such examinations, certain tax authorities, including the U.S. Internal

Revenue Service (‘‘IRS’’), have raised issues and proposed tax deficiencies. The Company is reviewing

the issues raised by the tax authorities and is contesting certain proposed tax deficiencies. Amounts

related to these tax deficiencies and other tax contingencies that management has assessed as probable

and estimable have been recorded through the income tax provision.

The calculation of our tax liabilities involves dealing with uncertainties in the application of

complex tax regulations in a multitude of jurisdictions across our global operations. We recognize

2005 Financials 105