ADT 2005 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

3. Charges for the Impairment of Long-Lived Assets (Continued)

The Company recorded charges for the impairment of property, plant and equipment of

$679 million at Corporate, of which $664 million related to the write-down of the TGN, which was

classified as held for sale, to its estimated fair value, less costs to dispose. The TGN was sold in 2005.

The remaining $15 million charge primarily related to the closure and relocation of corporate offices.

In addition, other impairment charges of $2 million and $1 million that were recorded at

Engineered Products and Services and Electronics, respectively.

4. Discontinued Operations and Divestitures

Discontinued Operations

In May 2005, Tyco announced its intent to explore the divesture of its Plastics and Adhesives

business segment, a global manufacturer of plastic film, specialty tapes and adhesives, coated products

and garment hangers. During 2005, as a result of consideration for potential sale and deteriorating

operating results in the A&E Products business, the Company performed an interim assessment of the

recoverability of both goodwill and long-lived assets in the Plastics and Adhesives segment. Estimated

fair values of the reporting units and long-lived assets in Plastics and Adhesives were developed based

on probability-weighted expected future cash flows of these assets. As a result of this assessment, the

Company determined that the book value of certain long-lived assets in the A&E Products reporting

unit of Plastics and Adhesives was greater than their estimated fair value and consequently recorded a

long-lived asset impairment of $40 million. The Company also determined that the book value of the

A&E Products reporting unit was in excess of its estimated fair value which resulted in a goodwill

impairment charge of $162 million. At September 30, 2005, the Plastics and Adhesives segment met the

held for sale criteria and its results of operations have been included in discontinued operations for all

periods presented. The Company is negotiating a sales agreement with potential buyers and expects to

complete a sale transaction in 2006. The Company has assessed the recoverability of the segment’s

carrying value at September 30, 2005 and will continue to assess recoverability based on current fair

values, less cost to sell, until the businesses are sold. Depending on the outcome of the sale

negotiations, the Company may incur additional impairment charges.

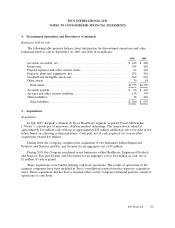

During 2005, the Company divested eight businesses which were reported as discontinued

operations within Fire and Security, Plastics and Adhesives and Engineered Products and Services. The

Company reported losses on sale or additional impairments to write the carrying value of such assets

down to their estimated fair value of $56 million during 2005. During 2004, the Company reported

losses on the sale of discontinued operations of $132 million, of which $36 million related to goodwill

impairments, to write the carrying value of such assets down to their fair value less cost to sell.

During 2003, Tyco recorded income from discontinued operations of $20 million for a restitution

payment made by Frank E. Walsh Jr., a former director.

2005 Financials 99