ADT 2005 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities

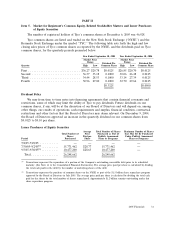

The number of registered holders of Tyco’s common shares at December 6, 2005 was 46,928.

Tyco common shares are listed and traded on the New York Stock Exchange (‘‘NYSE’’) and the

Bermuda Stock Exchange under the symbol ‘‘TYC.’’ The following table sets forth the high and low

closing sales prices of Tyco common shares as reported by the NYSE, and the dividends paid on Tyco

common shares, for the quarterly periods presented below.

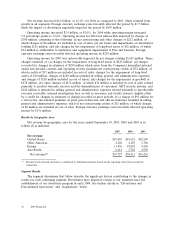

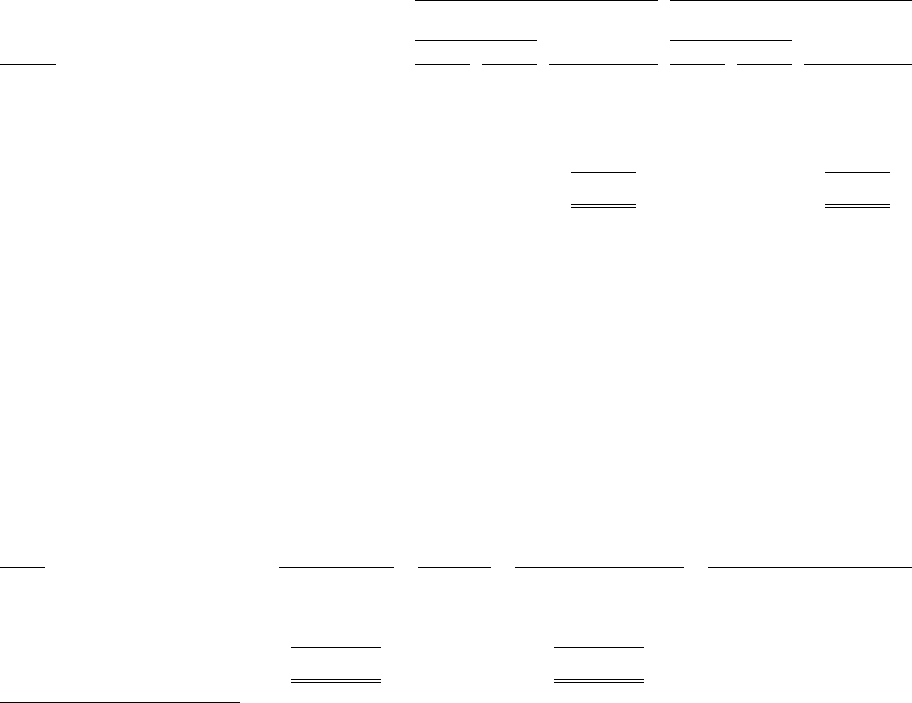

Year Ended September 30, 2005 Year Ended September 30, 2004

Market Price Market Price

Range Range

Dividend Per Dividend Per

Quarter High Low Common Share High Low Common Share

First .............................. $36.27 $29.78 $0.0125 $26.85 $20.70 $0.0125

Second ............................ 36.37 33.18 0.1000 30.06 26.48 0.0125

Third ............................. 34.44 28.53 0.1000 33.14 27.39 0.0125

Fourth ............................ 30.96 27.00 0.1000 32.70 29.66 0.0125

$0.3125 $0.0500

Dividend Policy

We may from time to time enter into financing agreements that contain financial covenants and

restrictions, some of which may limit the ability of Tyco to pay dividends. Future dividends on our

common shares, if any, will be at the discretion of our Board of Directors and will depend on, among

other things, our results of operations, cash requirements and surplus, financial condition, contractual

restrictions and other factors that the Board of Directors may deem relevant. On December 9, 2004,

the Board of Directors approved an increase in the quarterly dividend on our common shares from

$0.0125 to $0.10 per share.

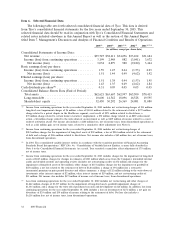

Issuer Purchases of Equity Securities

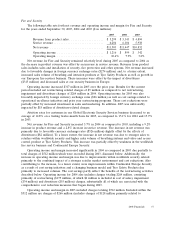

Average Total Number of Shares Maximum Number of Shares

Total Number of Price Purchased as Part of that May Yet Be Purchased

Shares Paid per Publicly Announced Under Publicly Announced

Period Purchased Share Plans or Programs Plans or Programs

7/2/05-7/29/05 ........... — — — —

7/30/05-9/2/05(1) .......... 15,771,462 $28.77 15,771,462 —

9/3/05-9/30/05(2) .......... 10,477,200 $28.63 10,477,200 —

Total ................ 26,248,662 26,248,662

(1) Transactions represent the repurchase of a portion of the Company’s outstanding convertible debt prior to its scheduled

maturity. (See Note 14 to the Consolidated Financial Statements). The average price paid per share is calculated by dividing

the total cash paid for the debt by the number of underlying shares of the debt.

(2) Transactions represent the purchase of common shares on the NYSE as part of the $1.5 billion share repurchase program

approved by the Board of Directors in July 2005. The average price paid per share is calculated by dividing the total cash

paid for the shares by the total number of shares repurchased. Approximately $1.2 billion remains outstanding under this

share repurchase program.

2005 Financials 31