ADT 2005 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

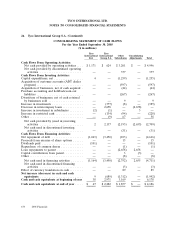

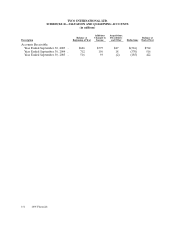

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

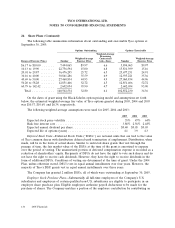

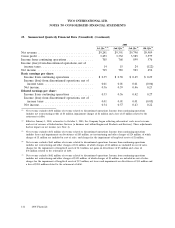

25. Summarized Quarterly Financial Data (Unaudited) (Continued)

2004

1st Qtr.(1)(2) 2nd Qtr.(3) 3rd Qtr.(4) 4th Qtr.(5)

Net revenue ................................ $9,241 $9,391 $9,790 $9,989

Gross profit ................................ 3,253 3,332 3,589 3,577

Income from continuing operations ............... 705 768 899 576

Income (loss) from discontinued operations, net of

income taxes .............................. 14 15 24 (122)

Net income ................................ 719 783 923 454

Basic earnings per share:

Income from continuing operations ............. $ 0.35 $ 0.38 $ 0.45 $ 0.29

Income (loss) from discontinued operations, net of

income taxes ............................ 0.01 0.01 0.01 (0.06)

Net income ............................... 0.36 0.39 0.46 0.23

Diluted earnings per share:

Income from continuing operations ............. 0.33 0.36 0.42 0.27

Income (loss) from discontinued operations, net of

income taxes ............................ 0.01 0.01 0.01 (0.05)

Net income ............................... 0.34 0.37 0.43 0.22

(1) Net revenue excludes $638 million of revenue related to discontinued operations. Income from continuing operations

includes net restructuring credits of $3 million, impairment charges of $1 million and a loss of $5 million related to the

retirement of debt.

(2) Effective January 1, 2004, retroactive to October 1, 2003, the Company began reflecting sub-contract costs in net revenue

and cost of revenue at Infrastructure Services (a business unit within Engineered Products and Services). These adjustments

had no impact on net income (see Note 1).

(3) Net revenue excludes $651 million of revenue related to discontinued operations. Income from continuing operations

includes losses and impairments on divestitures of $85 million, net restructuring and other charges of $24 million, of which

charges of $1 million are included in cost of sales, and charges for the impairment of long-lived assets of $1 million.

(4) Net revenue excludes $661 million of revenue related to discontinued operations. Income from continuing operations

includes net restructuring and other charges of $36 million, of which charges of $2 million are included in cost of sales,

charges for the impairment of long-lived assets of $13 million, net gains on divestitures of $3 million and a loss of

$38 million related to the retirement of debt.

(5) Net revenue excludes $681 million of revenue related to discontinued operations. Income from continuing operations

includes net restructuring and other charges of $155 million, of which charges of $3 million are included in cost of sales,

charges for the impairment of long-lived assets of $37 million, net losses and impairments on divestitures of $34 million and

a loss of $241 million related to the retirement of debt.

142 2005 Financials