ADT 2005 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

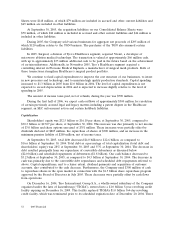

Our effective income tax rate was 23.5%, 27.5% and 45.2% for 2005, 2004 and 2003, respectively.

The decrease in the effective tax rate from 2004 to 2005 is primarily the result of the release of

valuation allowances, benefits realized related to the TGN divestiture, as well as the court-ordered

restitution award related to certain former executives for which there is no tax obligation and, to a

lesser extent, increased profitability in operations in jurisdictions with lower tax rates. This decrease is

partially offset by an increase in charges for which no tax benefit is available such as the loss on

retirement of debt, asset impairments and the estimated settlement of the SEC enforcement action.

The change in the effective tax rate from 2003 to 2004 was primarily the result of increased profitability

in operations primarily in jurisdictions with lower tax rates and a decrease in nondeductible charges.

The valuation allowance for deferred tax assets of $1,867 million and $1,967 million at

September 30, 2005 and 2004, respectively, relates principally to the uncertainty of the utilization of

certain deferred tax assets, primarily tax loss and credit carryforwards in various jurisdictions. We

believe that we will generate sufficient future taxable income to realize the tax benefits related to the

remaining net deferred tax assets on our Consolidated Balance Sheets. The valuation allowance was

calculated in accordance with the provisions of SFAS No. 109 which requires a valuation allowance be

established or maintained when it is ‘‘more likely than not’’ that all or a portion of deferred tax assets

will not be realized.

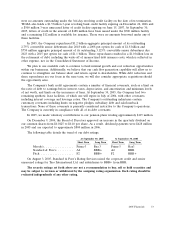

The calculation of our tax liabilities involves dealing with uncertainties in the application of

complex tax regulations in a multitude of jurisdictions across our global operations. We recognize

potential liabilities and record tax liabilities for anticipated tax audit issues in the U.S. and other tax

jurisdictions based on our estimate of whether, and the extent to which, additional taxes will be due.

These tax liabilities are reflected net of related tax loss carryforwards. We adjust these liabilities in light

of changing facts and circumstances; however, due to the complexity of some of these uncertainties, the

ultimate resolution may result in a payment that is materially different from our current estimate of the

tax liabilities. Further, management has reviewed with tax counsel the issues raised by these taxing

authorities and the adequacy of these recorded amounts. Substantially all of these potential tax

liabilities are recorded in other liabilities on the Consolidated Balance Sheets as payment is not

expected within one year.

The Company and its subsidiaries’ income tax returns are periodically examined by various tax

authorities. The Company is currently under audit by the IRS for the years 1997 to 2000. In connection

with such examinations, certain tax authorities, including the IRS, have raised issues and proposed tax

deficiencies. The Company is reviewing the issues raised by the tax authorities and is contesting certain

proposed tax deficiencies. Amounts related to these tax deficiencies and other tax contingencies that

management has assessed as probable and estimable have been recorded through the income tax

provision.

In connection with the IRS audits for the years 1997 to 2000, the Company prepared proposed

amendments to these prior period U.S. federal income tax returns resulting in a reduction in the

taxable income previously reported. The IRS is currently reviewing the proposed amendments. The

Company has not recorded the impact of the proposed amendments, pending the completion of the

IRS review. The proposed amendments, if accepted, will result in receipt of refunds or credits and a

corresponding reduction to the deferred tax assets and liabilities. The Company may prepare proposed

amendments to prior period U.S. federal income tax returns for additional periods. The proposed

amendments are not expected to have a material adverse impact on our financial condition, results of

operations or cash flows.

44 2005 Financials