ADT 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

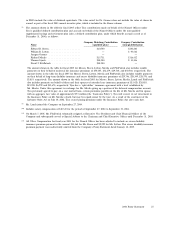

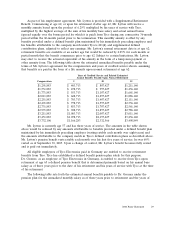

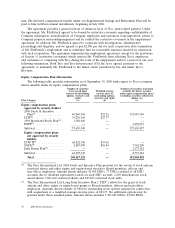

Option Grants in Last Fiscal Year

The following table shows all grants of stock options to the Named Officers during fiscal 2005

under the Tyco International Ltd. 2004 Stock and Incentive Plan.

Individual Grants

Percent of Total

No. of Securities Options

Underlying Granted Exercise Grant Date

Options to Employees in Price Expiration Present

Name Granted(2) Fiscal Year(4) ($/Share) Date Value(5)

Edward D. Breen(1) ............ 200,000 1.11% $37.00 3/09/2015 $2,453,920

200,000 1.11% $41.00 3/09/2015 $2,211,760

200,000 1.11% $45.00 3/09/2015 $1,997,920

William B. Lytton .............. 250,000 1.39% $35.80 3/09/2015 $2,887,700

Juergen Gromer ............... 83,333 .46% $35.80 3/09/2015 $ 962,563

166,667(3) .92% $35.80 4/09/2015 $1,925,137

Richard Meelia ................ 200,000 1.11% $35.80 3/09/2015 $2,310,160

Thomas Lynch ................ 200,000 1.11% $35.80 3/09/2015 $2,310,160

David J. FitzPatrick ............. —

(6) 0% — — —

(1) Mr. Breen received premium priced stock options in fiscal 2005. These option grants vest one-third

per year on each anniversary of the grant date, with an exercise price per share equal to $37.00

with respect to the first 200,000 options, $41.00 with respect to the second 200,000 options and

$45.00 with respect to the third 200,000 options. The premium priced options have a ten-year term,

subject in certain cases to earlier expiration following termination of employment.

(2) Except for Mr. Breen, options were granted at an exercise price equal to the fair market value of

Tyco common shares on the date of grant. The options vest one-third per year on each anniversary

of the grant date. Except as indicated for Dr. Gromer, options have a ten-year term, subject in

certain cases to earlier expiration following termination of employment.

(3) Represents the portion (two-thirds) of Dr. Gromer’s total option grants that are made with respect

to his Swiss employment services. These options expire ten years and one month from the date of

grant.

(4) Represents the percentage of all options granted in fiscal 2005 under the Tyco International Ltd.

2004 Stock and Incentive Plan.

(5) Tyco, like all public companies, is required to show the potential realizable value of stock options

or a grant date present value. Tyco chose to show a grant date present value using the Black-

Scholes option-pricing model, which is a method of calculating the hypothetical value of the

options on the date of grant. All options, except Mr. Breen’s premium priced options, were

granted at an exercise price equal to the market value of Tyco’s common shares on the date of

grant. The following assumptions were used in calculating the Black-Scholes values: expected time

of exercise of five years (except, with respect to Mr. Breen’s premium priced options, six years and

Mr. Lynch, four years); risk-free interest rate of 4.11% (except, with respect to Mr. Breen’s

premium priced options, 4.25%); assumed annual volatility of underlying shares of 33%; dividend

yield of 1.12%; and vesting of 1⁄3 each year for three years from the date of grant. The interest rate

represents the yield of a zero coupon U.S. government bond on the grant date with a maturity

date similar to the expected life of the option and the assumed annual volatility and dividend yield

26 2006 Proxy Statement