ADT 2005 Annual Report Download - page 134

Download and view the complete annual report

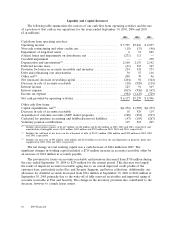

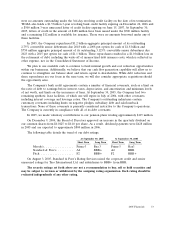

Please find page 134 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Within Electronics, backlog increased primarily due to stronger orders from improving business

conditions across the majority of its end markets. Backlog in Healthcare represents unfilled orders,

which, in the nature of the businesses, are normally shipped shortly after purchase orders are received.

We do not view backlog in Healthcare to be a significant indicator of the level of future sales activity.

Off-Balance Sheet Arrangements

Sale of Accounts Receivable

Tyco utilized several programs under which it sold participating interests in accounts receivable to

investors who, in turn, purchased and received ownership and security interests in those receivables. As

collections reduced accounts receivable included in the pool, the Company sold new receivables. The

Company retained the risk of credit loss on the receivables and, accordingly, the full amount of the

reserve was retained on the Consolidated Balance Sheets. The proceeds from the sales were used to

repay short-term and long-term borrowings and for working capital and other corporate purposes and

were reported as operating cash flows in the Consolidated Statements of Cash Flows. The sale

proceeds were less than the face amount of accounts receivable sold by an amount that approximated

the cost that would have been incurred if commercial paper had been issued backed by these accounts

receivable. The discount from the face amount is accounted for as a loss on the sale of receivables and

has been included in selling, general and administrative expenses in the Consolidated Statements of

Income. Such discount aggregated $18 million and $29 million, or 3.1% and 3.5% of the weighted-

average balance of the receivables outstanding, during 2004 and 2003, respectively. The Company

retained collection and administrative responsibilities for the participating interests in the defined pool.

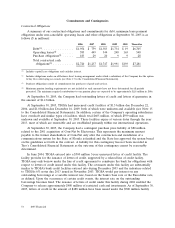

During 2004, the Company reduced outstanding balances under its accounts receivable programs

by $929 million, of which $812 million related to three of its corporate accounts receivable programs

which were terminated in 2005. No amounts were utilized under these programs at September 30, 2004

and through the date of termination. The remaining reduction of $117 million related to certain of the

Company’s international businesses selling fewer accounts receivable as a short-term financing

mechanism. These transactions qualify as true sales. The aggregate amount outstanding under

international accounts receivable programs was $80 million and $99 million at September 30, 2005 and

2004, respectively.

Variable Interest Entities

The Company has programs under which it sells machinery and equipment to investors who, in

turn, purchase and receive ownership and security interests in those assets. As such, the Company may

have certain investments in those affiliated companies whereby it provides varying degrees of financial

support and where the investors are entitled to a share in the results of those entities but do not

consolidate these entities. While these entities may be substantive operating companies, they have been

evaluated for potential consolidation under FIN No. 46.

The Company had three synthetic lease programs utilized, to some extent, by all of the Company’s

segments to finance capital expenditures for manufacturing machinery and equipment and for ships

used by Tyco Submarine Telecommunications. During 2003 the Company restructured one of the

synthetic leases to meet the requirements of FIN No. 46 for off-balance sheet accounting. In 2003 in

conjunction with adopting FIN No. 46, the Company also evaluated other investments and concluded

that four joint ventures that were previously accounted for under the equity method of accounting

within Tyco Infrastructure Services, in which we own a minority interest, met the consolidation criteria

set forth in FIN No. 46. Accordingly, these ventures were consolidated onto the Company’s balance

sheet effective July 1, 2003, and were subsequently deconsolidated as of March 31, 2004 upon the

adoption of FIN No. 46R.

58 2005 Financials