ADT 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of underlying shares was calculated based on 36 months of historical Tyco share price movement

and the dividend payments.

(6) On March 7, 2005, Mr. FitzPatrick voluntarily retired as Executive Vice President and Chief

Financial Officer of the Company and subsequently served as Special Advisor to the Chairman and

Chief Executive Officer until December 31, 2005. Mr. FitzPatrick did not receive any equity-based

compensation awards during fiscal 2005.

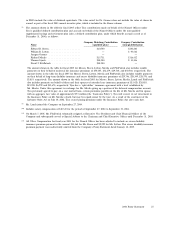

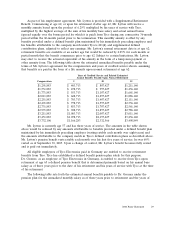

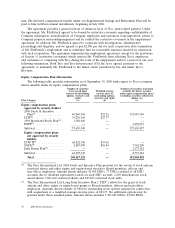

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

Shown below is information with respect to aggregate option exercises by the Named Officers in

the fiscal year ended September 30, 2005 and with respect to unexercised stock options held by them at

September 30, 2005.

No. of Securities

Underlying Value of Unexercised,

Number of Unexercised Options at In-the-Money Options

Shares Fiscal Year End Held at Fiscal Year End(1)

Acquired Value

Name On Exercise Realized Exercisable Unexercisable Exercisable Unexercisable

Edward D. Breen ............. — — 5,950,000 2,600,000 $102,350,000 $28,480,000

William B. Lytton ............. — — 748,334 416,666 $ 9,343,250 —

Juergen Gromer .............. — — 2,490,308 583,333 $ 4,852,100 $ 2,029,500

Richard Meelia .............. — — 2,547,608 533,333 $ 7,460,700 $ 2,029,500

Thomas Lynch ............... — — 138,334 476,666 — —

David FitzPatrick ............. — — 1,741,667 183,333 $ 19,074,000 —

(1) Based on the price of $27.80, which is the average of the high and low prices of Tyco common

shares on the NYSE on September 30, 2005.

Retirement Plans

Messrs. Breen, Lytton, Dr. Gromer and Messrs. Meelia and FitzPatrick participate in defined

benefit retirement plans (‘‘pension plans’’) maintained by Tyco or a subsidiary, as described below.

Mr. Lynch does not participate in these plans, but does participate in the Tyco International (US) Inc.

Supplemental Savings and Retirement Plan, as discussed below.

As part of his employment agreement, Mr. Breen is provided with a Supplemental Retirement

Benefit. Commencing at age 60, or upon his retirement if after age 60, Mr. Breen will receive a

monthly annuity based upon 50% of the highest average of the sum of his monthly base salary and

actual annual bonus (spread equally over the bonus period for which it is paid) from Tyco during any

consecutive 36-month period within the 60-month period prior to his termination. This monthly annuity

is offset by any benefits provided under a defined benefit plan maintained by any prior employer and

his benefits attributable to the company match under Tyco’s 401(k) and supplemental defined

contribution plans, increased at a specified interest rate. One-half of the monthly amount will continue

to his surviving spouse in the event of his death. Mr. Breen’s normal retirement date is at age 60.

Retirement benefits are available at an earlier age but would be reduced by 0.25% for each month or

partial month that he commences payment of the benefit prior to age 60 and an additional 0.25% each

month or partial month prior to age 60 if his termination of employment is without good reason or for

cause (as such terms are defined in his employment agreement). Subject to certain limitations,

Mr. Breen may elect to receive the actuarial equivalent of his annuity in the form of a lump sum

payment or installments. The following table shows the estimated annualized benefits payable under the

2006 Proxy Statement 27