ADT 2005 Annual Report Download - page 165

Download and view the complete annual report

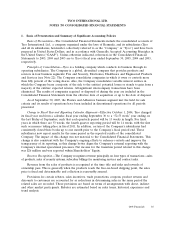

Please find page 165 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

underlying business. An impairment in the carrying value of an asset is recognized whenever anticipated

future cash flows (undiscounted) from an asset are estimated to be less than its carrying value. The net

book value of an asset is adjusted to fair value if its expected future undiscounted cash flows are less

than book value. The amount of the impairment recognized is the difference between the carrying

value of the asset and its fair value. Fair values are based on assumptions concerning the amount and

timing of estimated future cash flows and assumed discount rates, reflecting varying degrees of

perceived risk.

Goodwill—Goodwill is assessed for impairment at least annually and as triggering events occur. In

making this assessment, management relies on a number of factors including operating results, business

plans, economic projections, anticipated future cash flows, and transactions and market place data.

There are inherent uncertainties related to these factors and management’s judgment in applying them

to the analysis of goodwill impairment.

The Company has elected to make the first day of the fourth quarter the annual impairment

assessment date for all reporting units. Statement of Financial Accounting Standards No. 142 defines a

reporting unit as an operating segment or one level below an operating segment. Our reporting units as

of September 30, 2005 were as follows: Electronic Security Services, Fire Protection Contracting and

Services, Electronic Components, Wireless, Power Systems, Printed Circuit Group, Submarine

Telecommunications, Medical Devices & Supplies, Retail, Pharmaceuticals, Flow Control and Fire &

Building Products, Electrical and Metal Products, and Infrastructure Services. When changes occur in

the composition of one or more segments or reporting units, the goodwill is reassigned to the segments

or reporting units affected based on their relative fair value.

Goodwill valuations have been calculated using an income approach based on the present value of

future cash flows of each reporting unit. This approach incorporates many assumptions including future

growth rates, discount factors and income tax rates. Changes in economic and operating conditions

impacting these assumptions could result in a goodwill impairment in future periods.

Disruptions to the business such as end market conditions and protracted economic weakness,

unexpected significant declines in operating results of reporting units, the divestiture of a significant

component of a reporting unit, and market capitalization declines may result in our having to perform

a goodwill impairment first step valuation analysis for some or all of Tyco’s reporting units prior to the

required annual assessment. These types of events and the resulting analysis could result in additional

charges for goodwill and other asset impairments in the future.

Intangible Assets, Net—Intangible assets primarily include contracts and related customer

relationships, and intellectual property. Certain contracts and related customer relationships result from

purchasing residential security monitoring contracts from an external network of independent dealers

who operate under the ADT dealer program. Acquired contracts and related customer relationships are

recorded at their contractually determined purchase price. The Company incurs costs associated with

maintaining and operating its ADT dealer program, including brand advertising and due diligence,

which are expensed as incurred. In certain programs, dealers pay the Company a non-refundable

amount for each of the contracts sold to the Company. This non-refundable charge represents dealer

reimbursement to the Company for costs incurred by the Company associated with maintaining and

operating the ADT dealer program. Accordingly, each acquired contract and related customer

relationship was recorded at its contractually determined purchase price, net of a non-refundable

amount charged to dealers at the time the contract was accepted for purchase.

2005 Financials 89