ADT 2005 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

14. Debt (Continued)

The weighted-average rate of interest on total debt was 5.6% and 5.2% for the year ended

September 30, 2005 and 2004, respectively, excluding the impact of interest rate swaps. The weighted-

average rate of interest on all variable debt was 7.2% and 6.2% at September 30, 2005 and 2004,

respectively. The impact of the Company’s interest rate swap agreements on reported interest expense

was a reduction of $40 million, $66 million and zero for 2005, 2004 and 2003, respectively.

15. Guarantees

Certain of the Company’s business segments have guaranteed the performance of third-parties and

provided financial guarantees for uncompleted work and financial commitments. The terms of these

guarantees vary with end dates ranging from 2006 through the completion of such transactions. The

guarantees would be triggered in the event of nonperformance and the potential exposure for

nonperformance under the guarantees would not have a material effect on the Company’s financial

position, results of operations or cash flows.

In disposing of assets or businesses, the Company often provides representations, warranties and/or

indemnities to cover various risks including, for example, unknown damage to the assets, environmental

risks involved in the sale of real estate, liability to investigate and remediate environmental

contamination at waste disposal sites and manufacturing facilities, and unidentified tax liabilities and

legal fees related to periods prior to disposition. The Company does not have the ability to estimate

the potential liability from such indemnities because they relate to unknown conditions. However, the

Company has no reason to believe that these uncertainties would have a material adverse effect on the

Company’s financial position, annual results of operations or cash flows.

The Company has recorded liabilities for known indemnifications included as part of

environmental liabilities. See Note 17 for a discussion of these liabilities.

The Company has guaranteed the fair value of certain vessels not to exceed $235 million, and as of

September 30, 2005 expects the obligation to be $54 million, which is recorded in the accompanying

Consolidated Balance Sheet, based on its estimate of the fair value of the vessels (see Note 17).

In the normal course of business, the Company is liable for contract completion and product

performance. In the opinion of management, such obligations will not significantly affect the

Company’s financial position, results of operations or cash flows.

The Company generally records estimated product warranty costs at the time of sale. For further

information on estimated product warranty, see Note 1.

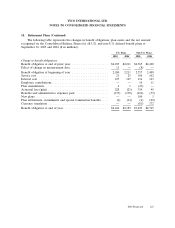

Following is a roll forward of the Company’s warranty liability for 2005 ($ in millions):

Balance at September 30, 2004 ................................... $292

Warranties issued during the year ................................. 57

Changes in estimates related to pre-existing warranties ................. (27)

Settlements ................................................. (127)

Foreign currency translation ..................................... (2)

Balance at September 30, 2005 ................................... $193

2005 Financials 115