ADT 2005 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

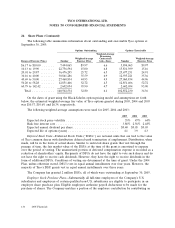

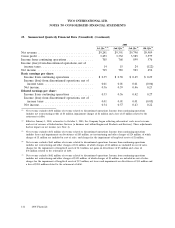

20. Share Plans (Continued)

The 2004 Plan provides for a maximum of 160 million common shares to be issued as Awards,

subject to adjustment as provided under the terms of the 2004 Plan. In addition, any common shares

that have been approved by the Company’s shareholders for issuance under the 1994 Plan and the

LTIP Plans but which have not been awarded thereunder as of January 1, 2004, reduced by the number

of common shares related to Awards made under the LTIP Plans between January 1, 2004 and

March 25, 2004, the date the 2004 Plan was approved by shareholders, (or which have been awarded

but will not be issued, owing to expiration, forfeiture, cancellation, return to the Company or

settlement in cash in lieu of common shares on or after January 1, 2004) and which are no longer

available for any reason (including the termination of the 1994 Plan or the LTIP Plans) will also be

available for issuance under the 2004 Plan. When common shares are issued pursuant to a grant of

restricted stock, restricted units, deferred stock units, promissory stock, performance units or as

payment of an annual performance bonus or other stock-based award, the total number of common

shares remaining available for grant will be decreased by a margin of at least 1.8 per common share

issued. At September 30, 2005, there were approximately 172 million shares available for future grant

under the 2004 Plan (including shares available under both the LTIP I and LTIP II Plans which are

now assumable under the 2004 Plan).

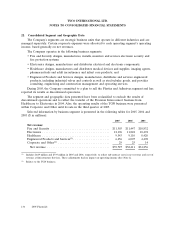

The 1994 Plan provided for the issuance of restricted stock grants to officers and non-officer

employees. In November 2004, and upon expiration of the 1994 Plan, all 20 million shares available for

future issuance under the 1994 Plan were assumed by the 2004 Plan. At September 30, 2005, 21 million

shares had been granted, of which 5 million were granted under the 2004 Plan and 16 million were

granted under the former 1994 Plan.

The LTIP I Plan reserved common shares for issuance to Tyco’s directors, executives and managers

as share options. This plan is administered by the Compensation and Human Resources Committee of

the Board of Directors of the Company, which consists exclusively of independent directors of the

Company. Tyco had reserved 140 million common shares for issuance under the LTIP I Plan. At

September 30, 2005, there were approximately 28 million shares originally reserved for issuance under

this plan but now available for future grant under the 2004 Plan.

The LTIP II Plan was a broad-based option plan for non-officer employees. Tyco had reserved

100 million common shares for issuance under the LTIP II Plan. The terms and conditions of this plan

are similar to the LTIP I Plan. At September 30, 2005, there were approximately 24 million shares

originally reserved for issuance under this plan but now available for future grant under the 2004 Plan.

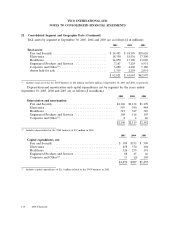

Restricted Shares—Common shares are awarded subject to certain restrictions. Conditions of

vesting are determined at the time of grant under the 2004 Plan; unless otherwise stated, stock vests in

equal annual installments over a period of four years. However, the majority of Tyco’s restricted share

grants cliff vest after three years. All restrictions on the stock will lapse upon normal retirement, death

or disability of the employee.

For grants which vest based on certain specified performance criteria, the fair market value of the

shares are expensed over the period of performance, once achievement of criteria is deemed probable.

For grants that vest through passage of time, the fair market value of the shares at the time of the

grant is amortized to expense over the period of vesting. Unamortized compensation expense is

recorded as a reduction of shareholders’ equity. Recipients of restricted shares have the right to vote

such shares and receive dividends. Income tax benefits resulting from the vesting of restricted shares,

including a deduction for the excess, if any, of the fair market value of restricted shares at the time of

132 2005 Financials