ADT 2005 Annual Report Download - page 116

Download and view the complete annual report

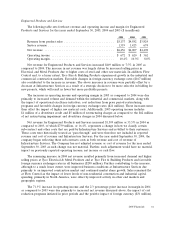

Please find page 116 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The decreases in operating income and operating margin in 2005 as compared to 2004 were due

primarily to a $277 million charge recorded in the fourth quarter of 2005, associated with the adverse

decision by the United States Court of Appeals for the Federal Circuit on a previously disclosed legal

matter. (Refer to Note 17 to the Consolidated Financial Statements for further discussion.) This

charge, combined with declines in the Retail division as a result of the competitive environment

mentioned above as well as increased material and transportation costs, was offset by substantial

increases from other divisions, specifically the International and Surgical divisions within Medical

Devices & Supplies as well as within Pharmaceutical. Increases in these divisions were due to strong

sales growth as mentioned above, combined with a favorable product mix. Also positively impacting the

segment were reduced administrative expenses at the segment level, as well as favorable foreign

exchange rates ($41 million).

In November of 2005, the Mallinckrodt Imaging Division voluntarily recalled two medical imaging

products from the market. In each instance, Healthcare was concerned with the procedures that were

being used to assure the sterility of each product. Healthcare has not received any reports of adverse

events involving patient health or safety with regard to either product. Healthcare’s Mallinckrodt

Imaging Division will not restart the manufacture of the products until all corrective actions have been

implemented. Healthcare does not expect that the voluntary recall of these two products in November

of 2005 will have a material adverse impact on the Company.

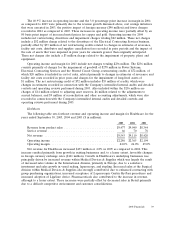

Net revenue for Healthcare increased 8.2% in 2004 as compared to 2003. The increase in net

revenue resulted primarily from growth in existing businesses as well as favorable foreign currency

exchange rates ($292 million). Growth in Healthcare’s underlying businesses was primarily a result of

increased net revenue within Medical Devices & Supplies, and to a lesser extent, at Pharmaceuticals.

The increase at Medical Devices & Supplies was largely driven by higher sales volume within our

International division, particularly in Europe, due to benefits realized from the sales force investment,

back order recovery, growth in Spain and Italy and the absence of an unfavorable $47 million

contractual adjustment recorded in 2003. Also contributing to the increase in Medical Devices &

Supplies were higher sales within the Medical division resulting primarily from new SharpSafety

product launches and gain in market share within the wound care market.

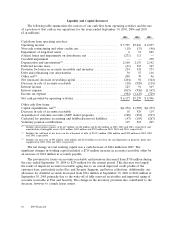

The 12.4% increase in operating income in 2004 as compared to 2003 was due primarily to the

favorable margin impact of the increased sales discussed above, favorable foreign currency exchanges

rates and a continued focus on maximizing operating efficiencies. Operating income was adversely

impacted by a $29 million increase in legal liabilities for an ongoing patent infringement suit, and a

$59 million increase in research and development costs. Additionally, operating income for 2004

includes net restructuring, divestitures and impairment charges of $18 million, composed of:

(i) restructuring charges of $13 million related to the closure of various facilities offset by a credit of

$2 million due to costs being less than anticipated; (ii) a $4 million divestiture charge resulting from a

loss on the sale of a business and (iii) $3 million of impairment charges related to the closure of

various facilities.

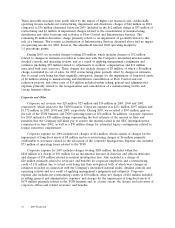

During 2003, Healthcare recorded net credits totaling $2 million, including restructuring credits of

$8 million due to actual costs being less than anticipated, and a credit of $7 million related to an

insurance reimbursement for certain legal fees associated with product liability cases. These credits

were largely offset by charges of $12 million related to asset reserves for inventory and charges of

$1 million for adjustments to accrual balances related to workers’ compensation, which were changes in

estimates recorded in connection with the Company’s intensified internal audits, detailed controls and

operating reviews and as a result of applying management’s judgments and estimates.

40 2005 Financials