ADT 2005 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

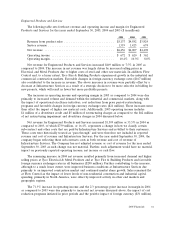

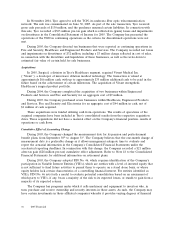

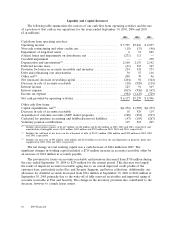

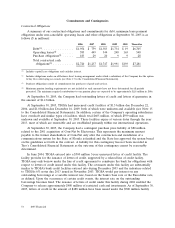

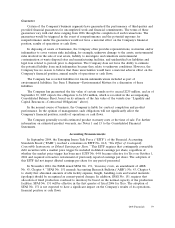

Cash flows from operating activities and other cash flow items by segment were as follows for the

year ended September 30, 2005 ($ in millions):

Engineered

Products Corporate

Fire and and and

Security Electronics Healthcare Services Other Total

Cash flows from operating activities:

Operating income (loss) ............. $1,216 $1,852 $2,286 $672 $ (231) $ 5,795

Restructuring, impairment and other

(credits) charges, net .............. — (11) 3 2 (6) (12)

Non-cash losses and impairments on

divestitures, net .................. 18 — 8 (1) (296) (271)

Depreciation .................... 582 491 262 104 8 1,447

Intangible assets amortization ........ 524 68 57 4 — 653

Depreciation and amortization ......... 1,106 559 319 108 8 2,100

Deferred income taxes .............. — — — — (41) (41)

Provision for losses on accounts receivable

and inventory ................... 71 84 41 38 — 234

Debt and refinancing cost amortization . . . — — — — 30 30

Net (increase) decrease in working capital

and other(1) .................... (277) (311) 236 (88) 436 (4)

Decrease in sale of accounts receivable . . . (8) (1) (9) — — (18)

Interest income ................... — — — — 123 123

Interest expense ................... — — — — (815) (815)

Income tax expense ................. — — — — (984) (984)

Net cash provided by operating activities . . $2,126 $2,172 $2,884 $731 $(1,776) $ 6,137

Other cash flow items:

Capital expenditures, net ............. $(389) $ (458) $ (326) $(88) $ (11) $(1,272)

Decrease in sale of accounts receivable . . . 8 1 9 — — 18

Acquisition of customer accounts (ADT

dealer program) ................. (328) — — — — (328)

Cash paid for purchase accounting and

holdback/earn-out liabilities .......... (10) (18) (14) (5) — (47)

Voluntary pension contributions ........ 82 25 8 — — 115

(1) Includes the add back of $1,013 million related to a loss on the retirement of debt.

During 2005, 2004 and 2003 we paid out $161 million, $228 million and $499 million, respectively,

in cash related to restructuring activities. See Note 2 to our Consolidated Financial Statements for

further information regarding our restructuring activities. We anticipate a cash outflow of approximately

$50 million in 2006 related to restructuring activities in our Electronics segment.

During 2005, 2004 and 2003, Tyco paid $328 million, $254 million and $597 million of cash,

respectively, to acquire 0.4 million, 0.3 million and 0.6 million customer contracts for electronic security

services through the ADT dealer program.

During 2005, 2004 and 2003, we paid $47 million, $105 million and $267 million, respectively, in

cash for purchase accounting and holdback/earn-out liabilities. Holdback liabilities represent a portion

of the purchase price that is withheld from the seller pending finalization of the acquisition balance

sheet. Certain acquisitions have provisions which require Tyco to make additional ‘‘earn-out’’ payments

to the sellers if the acquired company achieves certain milestones subsequent to its acquisition by Tyco.

These earn-out payments are tied to certain performance measures, such as revenue, gross margin or

earnings growth. At September 30, 2005 holdback/earn-out liabilities on our Consolidated Balance

2005 Financials 51