ADT 2005 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

8. Cumulative Effect of Accounting Change (Continued)

assessment of which party to VIE’s, if any, bears a majority of the risk to its expected losses, or stands

to gain from a majority of its expected returns.

The Company has programs under which it sells machinery and equipment to investors who, in

turn, purchase and receive ownership and security interests in those assets. As such, the Company may

have certain investments in those affiliated companies whereby it provides varying degrees of financial

support and where the investors are entitled to a share in the results of those entities, but the

Company does not consolidate these entities. While these entities may be substantive operating

companies, they have been evaluated for potential consolidation under FIN No. 46.

The Company had three synthetic lease programs utilized, to some extent, by all of the Company’s

segments to finance capital expenditures for manufacturing machinery and equipment and for ships

used by Tyco Submarine Telecommunications. During 2003, the Company adopted FIN No. 46 and,

accordingly, restructured one of the synthetic leases to meet the requirements of FIN No. 46 for

off-balance sheet accounting. The Company reclassified the remaining two leases as capital leases and,

consequently, recorded a $75 million after-tax loss ($115 million pretax) cumulative effect adjustment.

One of the capital leases expired in December 2004 and the other is scheduled to expire in July 2006.

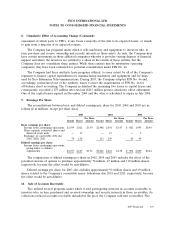

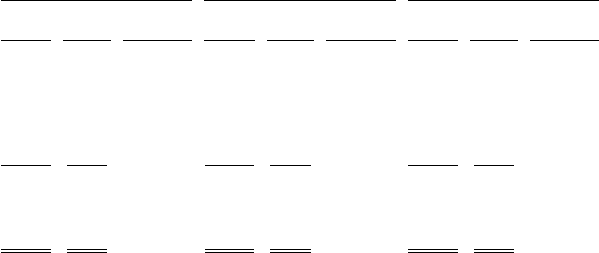

9. Earnings Per Share

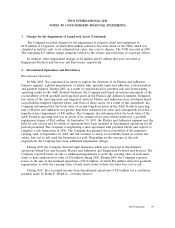

The reconciliations between basic and diluted earnings per share for 2005, 2004 and 2003 are as

follows ($ in millions, except per share data):

2005 2004 2003

Per Share Per Share Per Share

Income Shares Amount Income Shares Amount Income Shares Amount

Basic earnings per share:

Income from continuing operations $3,199 2,012 $1.59 $2,948 2,001 $1.47 $ 882 1,995 $0.44

Share options, restricted shares and

deferred stock units ......... — 17 — 15 — 5

Exchange of convertible debt due

2010, 2020, 2021 ............ 74 138 113 205 24 49

Diluted earnings per share:

Income from continuing operations,

giving effect to dilutive

adjustments ............... $3,273 2,167 $1.51 $3,061 2,221 $1.38 $ 906 2,049 $0.44

The computation of diluted earnings per share in 2005, 2004 and 2003 excludes the effect of the

potential exercise of options to purchase approximately 72 million, 67 million and 110 million shares,

respectively, because the effect would be anti-dilutive.

Diluted earnings per share for 2003 also excludes approximately 94 million shares and 49 million

shares related to the Company’s convertible senior debentures due 2018 and 2023, respectively, because

the effect would be anti-dilutive.

10. Sale of Accounts Receivable

Tyco utilized several programs under which it sold participating interests in accounts receivable to

investors who, in turn, purchased and received ownership and security interests in those receivables. As

collections reduced accounts receivable included in the pool, the Company sold new receivables. The

2005 Financials 107