ADT 2005 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.impact on our future earnings. If a change in a valuation allowance occurs, which was established in

connection with an acquisition, such adjustment may impact goodwill rather than the income tax

provision.

Changes in tax laws and rates could also affect recorded deferred tax assets and liabilities in the

future. Management is not aware of any such charges that would have a material effect on the

Company’s results of operations, cash flows or financial position.

In addition, the calculation of our tax liabilities involves dealing with uncertainties in the

application of complex tax regulations in a multitude of jurisdictions across our global operations. We

recognize potential liabilities and record tax liabilities for anticipated tax audit issues in the U.S. and

other tax jurisdictions based on our estimate of whether, and the extent to which, additional taxes will

be due. These tax liabilities are reflected net of related tax loss carryforwards. We adjust these reserves

in light of changing facts and circumstances; however, due to the complexity of some of these

uncertainties, the ultimate resolution may result in a payment that is materially different from our

current estimate of the tax liabilities. If our estimate of tax liabilities proves to be less than the ultimate

assessment, an additional charge to expense would result. If payment of these amounts ultimately

proves to be less than the recorded amounts, the reversal of the liabilities would result in tax benefits

being recognized in the period when we determine the liabilities are no longer necessary. If the tax

liabilities relate to tax uncertainties existing at the date of the acquisition of a business, the adjustment

of such tax liabilities will result in an adjustment to the goodwill recorded at the date of acquisition.

Goodwill—In performing the goodwill assessments, management relies on a number of factors

including operating results, business plans, economic projections, anticipated future cash flows, and

transactions and market place data. There are inherent uncertainties related to these factors and

management’s judgment in applying them to the analysis of goodwill impairment. Since management’s

judgment is involved in performing goodwill valuation analyses, there is risk that the carrying value of

our goodwill may be overstated or understated.

We elected to make the first day of the fourth quarter the annual impairment assessment date for all

reporting units. Goodwill valuations have been calculated using an income approach based on the present

value of future cash flows of each reporting unit. This approach incorporates many assumptions including

future growth rates, discount factors and income tax rates. Changes in economic and operating conditions

impacting these assumptions could result in a goodwill impairment in future periods.

Disruptions to our business such as end market conditions and protracted economic weakness,

unexpected significant declines in operating results of reporting units, the divestiture of a significant

component of a reporting unit and market capitalization declines may result in our having to perform a

goodwill impairment first step valuation analysis for some or all of our reporting units prior to the

required annual assessment. These types of events and the resulting analysis could result in goodwill

impairment charges in the future.

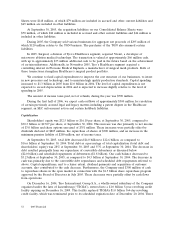

The Company recorded goodwill impairments of $162 million in 2005, included in (loss) income

from discontinued operations, and $96 million in 2004, of which $36 million is included in (loss) income

from discontinued operations and the remaining $60 million is included in (gains) losses and

impairments on divestitures, net on the Consolidated Statements of Income. Goodwill impairments in

2003 totaled $278 million.

Long-Lived Assets—Assets held and used by the Company, including property, plant and

equipment and intangible assets, are reviewed for impairment whenever events or circumstances

indicate that the carrying amount of an asset may not be recoverable. For purposes of evaluating the

recoverability of long-lived assets to be held and used, a recoverability test is performed based on

assumptions concerning the amount and timing of estimated future cash flows and assumed discount

rates, reflecting varying degrees of perceived risk. Impairments to long-lived assets to be disposed of

are recorded based upon the fair value of the applicable assets. Since judgment is involved in

determining the fair value and useful lives of long-lived assets, there is a risk that the carrying value of

our long-lived assets may be overstated or understated.

2005 Financials 49