ADT 2005 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asbestos Matters

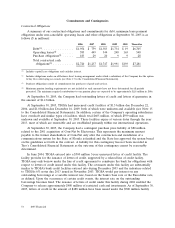

Tyco and some of its subsidiaries are named as defendants in personal injury lawsuits based on

alleged exposure to asbestos-containing materials. Consistent with the national trend of increased

asbestos-related litigation, the Company has observed an increase in the number of these lawsuits in

the past several years. The majority of these cases have been filed against subsidiaries in Healthcare

and Engineered Products and Services. A limited number of the cases allege premises liability, based

on claims that individuals were exposed to asbestos while on a subsidiary’s property. A majority of the

cases involve product liability claims, based principally on allegations of past distribution of

heat-resistant industrial products incorporating asbestos or the past distribution of industrial valves that

incorporated asbestos-containing gaskets or packing. Each case typically names between dozens to

hundreds of corporate defendants.

Tyco’s involvement in asbestos cases has been limited because its subsidiaries did not mine or

produce asbestos. Furthermore, in the Company’s experience, a large percentage of these claims were

never substantiated and have been dismissed by the courts. The Company will continue to vigorously

defend these lawsuits and the Company has not suffered an adverse verdict in a trial court proceeding

related to asbestos claims.

When appropriate, the Company settles claims; however, the total amount paid to date to settle

and defend all asbestos claims has been immaterial. As of September 30, 2005, there were

approximately 14,000 asbestos liability cases pending against the Company and its subsidiaries.

During the 2005, the Company undertook a detailed study of its pending asbestos claims and also

developed an estimate of asbestos claims that were incurred but not reported, as well as related

insurance and indemnification recoveries. The impact of this study was not material to the Company’s

financial position, results of operations or cash flows. The Company’s estimate of the liability for

pending and future claims is based on claim experience over the past five years and covers claims

expected to be filed through 2012. The Company believes that it has adequate amounts recorded

related to these matters. While it is not possible at this time to determine with certainty the ultimate

outcome of these asbestos-related proceedings, the Company believes that the final outcome of all

known and anticipated future claims, after taking into account its substantial indemnification rights and

insurance coverage, will not have a material adverse effect on the Company’s financial position, results

of operations or cash flows.

Income Taxes

Tyco and its subsidiaries’ income tax returns are periodically examined by various regulatory tax

authorities. In connection with such examinations, tax authorities, including the United States Internal

Revenue Service, have raised issues and proposed tax deficiencies. The Company is reviewing the issues

raised by the tax authorities and is contesting certain of the proposed tax deficiencies. Amounts related

to these tax deficiencies and other tax contingencies that management has assessed as probable and

estimable have been recorded through the income tax provision, equity or goodwill, as applicable. The

American Jobs Creation Act of 2004 (the ‘‘AJCA’’), signed into law in October 2004, replaces an export

incentive with a deduction from domestic manufacturing income. It is not expected that the AJCA will

have a material impact on the Company’s income tax provision. The AJCA also allows the Company to

repatriate up to $500 million of permanently reinvested foreign earnings in 2006 at an effective tax rate

of 5.25%. This incentive would apply to the Company’s U.S. owned controlled foreign companies. The

Company continues to review whether to take advantage of this provision of the AJCA.

56 2005 Financials