ADT 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

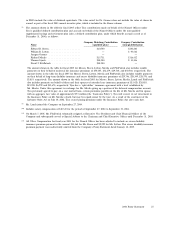

(other than for cause) or (ii) a change in control of the Company. Upon such termination or

change in control, as the case may be, the Company will issue to the individual the number of Tyco

common shares equal to the aggregate number of vested DSUs credited to the individual,

including DSUs received through the accrual of dividend equivalents.

(4) Includes the maximum number of shares as to which these individuals can acquire beneficial

ownership upon the exercise of stock options that are currently vested or will vest before

December 2, 2005 as follows: Admiral Blair, 20,000; Mr. Breen, 5,950,000; Mr. FitzPatrick,

1,741,667; Mr. Gordon, 20,000; Dr. Gromer, 2,490,308; Mr. Krol, 24,110; Mr. Lynch, 138,334;

Mr. Lytton, 748,334; Mr. McCall, 20,000; Mr. McDonald, 20,000; Mr. Meelia, 2,547,608;

Dr. O’Neill, 20,000; Ms. Wijnberg, 20,000; and Mr. York, 20,000.

(5) Includes 4,000 shares owned by Mr. Gupta’s spouse.

(6) Includes 9,700 shares held indirectly as to which voting and/or investment power is shared with or

controlled by another person and as to which voting beneficial ownership is not disclaimed.

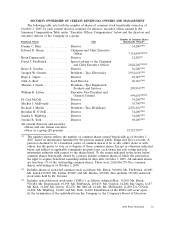

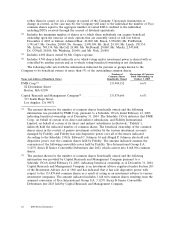

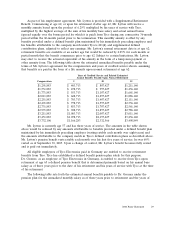

The following table sets forth the information indicated for persons or groups known to the

Company to be beneficial owners of more than 5% of the outstanding common shares.

Number of Percentage of Common

Common Shares Stock Outstanding on

Name and Address of Beneficial Owner Beneficially Owned October 3, 2005

FMR Corp.(1) ..................................... 133,904,152 6.6%

82 Devonshire Street

Boston, MA 02109

Capital Research and Management Company(2) ............ 133,874,660 6.6%

333 South Hope Street

Los Angeles, CA 90071

(1) The amount shown for the number of common shares beneficially owned and the following

information was provided by FMR Corp. pursuant to a Schedule 13G/A dated February 14, 2005,

indicating beneficial ownership as of December 31, 2004. The Schedule 13G/A indicates that FMR

Corp., on behalf of certain of its direct and indirect subsidiaries, and Fidelity International

Limited, on behalf of certain of its direct and indirect subsidiaries (collectively, ‘‘Fidelity’’),

indirectly held the indicated number of common shares. The beneficial ownership of the common

shares arises in the context of passive investment activities by the various investment accounts

managed by Fidelity, and Fidelity has sole dispositive power over all of the shares indicated.

According to the Schedule 13G/A, Edward C. Johnson 3d and Abigail P. Johnson also hold sole

dispositive power over the common shares held by Fidelity. The amount indicated assumes the

conversion of the following convertible notes held by Fidelity: Tyco International Group S.A.

3.125% Series B Senior Convertible Debentures due 2023, which convert into 8,468,986 common

shares.

(2) The amount shown for the number of common shares beneficially owned and the following

information was provided by Capital Research and Management Company pursuant to a

Schedule 13G/A dated February 14, 2005, indicating beneficial ownership as of December 31, 2004.

Capital Research and Management Company is an investment advisor registered under Section 203

of the Investment Advisor Act of 1940 and has indicated that it has sole dispositive power with

respect to the 133,874,660 common shares as a result of acting as an investment advisor to various

investment companies. The amount indicated includes 3,448,660 common shares resulting from the

assumed conversion of Tyco International Group S.A. 3.125% Series B Senior Convertible

Debentures due 2023 held by Capital Research and Management Company.

22 2006 Proxy Statement