ADT 2005 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SENIOR MANAgEMENT TEAM

BOARD OF DIRECTO R S

REgISTERED & PRINCIPAL EXECUTIVE OFFICE

INDEPENDENT AUDITORS

ShAREhOLDER SERVICES STOCk EXChANgES

TyCO ON ThE INTERNET

TRADEMARkS

CORPORATE DATA

NON-gAAP MEASURES

FREE CASh FLOw RECONCILIATION

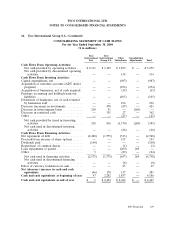

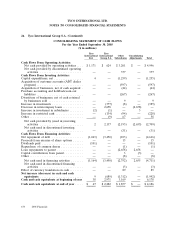

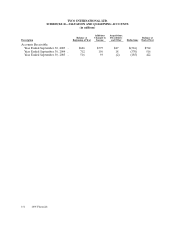

RECONCILIATION TO “FREE CASH FLOW”: 2005 2004 2003

Net cash provided by operating activities $6,137 $5,279 $4,996

Decrease in accounts receivable programs 18 929 119

Capital expenditures, net (1,272) (987) (1,255)

Acquisition of customer accounts (ADT dealer program) (328) (254) (597)

Cash paid for purchase accounting and holdback/earn-out liabilities (47) (105) (267)

Voluntary pension contributions 115 567 205

FREE CASH FLOW $4,623 $5,429 $3,201

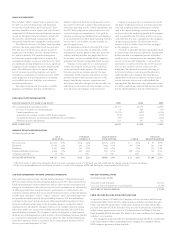

ORgANIC gROw Th RECONCILIATI O N

(Year Ended September 30, 2005)

NET FOREIGN ACQUISITION/ ORGANIC

REVENUES CURRENCY DIVESTITURE OTHER REVENUE GROWTH

Fire & Security $11,503 0.5% $274 2.4% $(315) -2.8% $ — 0.0% $ 97 0.9%

Electronics 12,196 3.2% 294 2.5% (346) -3.0% 39(1) 0.3% 387 3.4%

Healthcare 9,543 4.8% 141 1.5% (18) -0.1% — 0.0% 310 3.4%

Engineered Products & Services 6,456 7.5% 167 2.8% (14) -0.3% (18)(2) -0.3% 314 5.3%

Corporate and Other 29 NM — NM 4 NM — NM — NM

TOTAL NET REVENUES $39,727 3.4% $876 2.3% $(689) -1.9% $ 21 0.1% $1,108 2.9%

(1) Effective October 1, 2004, Tyco changed its fiscal year from a calendar year to a 52/53-week year and conformed the closing periods of certain subsidiaries.

(2) Reflects the deconsolidation of several joint ventures as a result of the adoption of FIN 46R during the second quarter of fiscal 2004.

“Free cash flow” (FCF), “organic revenue growth,” and

“net debt” are non-GAAP measures and should not

be considered replacements for GAAP results. These

measures should be used in conjunction with the most

comparable GAAP financial measures. Investors are urged

to read the Company’s financial statements as filed with

the Securities and Exchange Commission for more

information about the most comparable GAAP measures.

The difference between Cash Flows from Operating

Activities (the most comparable GAAP measure) and

FCF (the non-GAAP measure) consists mainly of

significant cash outflows that the company believes

are useful to identify. FCF permits management

and investors to gain insight into the number that

management employs to measure cash that is free from

any significant existing obligation. It is also a significant

component in the company’s incentive compensation

plans. The difference reflects the impact from: the

sale of accounts receivable programs, net capital

expenditures, acquisition of customer accounts (ADT

dealer program), cash paid for purchase accounting

and holdback/earn-out liabilities, and voluntary

pension contributions.

The impact from the sale of accounts receivable

programs and voluntary pension contributions is

added or subtracted from the GAAP measure because

this activity is driven by economic financing decisions

rather than operating activity. Capital expenditures and

the ADT dealer program are subtracted because they

represent long-term commitments. Cash paid for

purchase accounting and holdback/earn-out liabilities

is subtracted from Cash Flow from Operating Activities

because these cash outflows are not available for

general corporate uses.

The limitation associated with using FCF is that

it subtracts cash items that are ultimately within

management’s and the Board of Directors’ discretion

to direct and that therefore may imply that there is

less or more cash that is available for the company’s

programs than the most comparable GAAP measure.

“Organic revenue growth” is a useful measure

used by the company to measure the underlying

results and trends in the business. The difference

between reported net revenue growth (the most

comparable GAAP measure) and organic revenue

growth (the non-GAAP measure) consists of the

impact from foreign currency, acquisitions and

divestitures, and other changes that do not reflect the

underlying results and trends (for example, revenue

reclassifications and changes to the fiscal year).

Organic revenue growth is a useful measure of the

company’s performance because it excludes items that:

i) are not completely under management’s control,

such as the impact of foreign currency exchange; or

ii) do not reflect the underlying growth of the company,

such as acquisition and divestiture activity, or revenue

reclassification. It is also a component of the company’s

compensation programs. The limitation of this

measure is that it excludes items that have an impact

on the company’s revenue.

“Net debt” is total debt (the most comparable GAAP

measure) minus cash and cash equivalents. Management

believes net debt is an important measure of liquidity,

which it uses as a tool to measure the company’s ability

to meet its future debt obligations. Cash and cash

equivalents are subtracted from the GAAP measure

because they could be used to reduce our debt

obligations. The limitation associated with using net

debt is that it subtracts cash items and therefore may

imply that there is less company debt than the most

comparable GAAP measure indicates and may include

certain cash items that are not readily available for

repaying debt. This limitation is best addressed by using

net debt in combination with total debt because net debt

may be significantly lower than the GAAP measure.

CAUTION CONCERNINg FORwARD-LOOkINg STATEMENTS

This report may contain certain “forward-looking statements” within the meaning of

the United States Private Securities Litigation Reform Act of 1995. These statements are

based on management’s current expectations and are subject to risks, uncertainty, and

changes in circumstances, which may cause actual results, performance, or achievements

to differ materially from anticipated results, performance, or achievements. All

statements contained herein that are not clearly historical in nature are forward-looking

and the words “anticipate,” “believe,” “expect,” “estimate,” “plan,” and similar expressions

are generally intended to identify forward-looking statements. The forward-looking

statements in this report include statements addressing the following subjects: future

financial condition and operating results. Economic, business, competitive and/or

regulatory factors affecting the Company’s businesses are examples of factors, among

others, that could cause actual results to differ materially from those described in the

forward-looking statements. The Company is under no obligation to (and expressly

disclaims any such obligation to) update or alter its forward-looking statements whether

as a result of new information, future events, or otherwise. More detailed information

about these and other factors is set forth in Tyco’s Annual Report on Form 10-K for

the fiscal year ended September 30, 2005.

NET DEBT RECONCILIATION

(Year Ended September 30, 2005)

Total debt at end of period $12,554

Less: cash and cash equivalents at end of period (3,196)

NET DEBT AT END OF PERIOD $ 9,358

FORM 10-k AND SEC AND NySE CERTIFICATI O N S

A copy of the Form 10-K filed by the Company with the Securities and Exchange

Commission (SEC) for fiscal 2005, which includes as Exhibits the Chief Executive

Officer and Chief Financial Officer Certifications required to be filed with the SEC

pursuant to Section 302 of the Sarbanes-Oxley Act, may be obtained by shareholders

without charge upon written request to Tyco International, 2nd Floor, 90 Pitts Bay

Road, Pembroke HM 08, Bermuda. The Form 10-K is also available on the Company’s

website at www.tyco.com.

The Company has filed with the New York Stock Exchange (NYSE) the Certification

of its Chief Executive Officer confirming that the Company has complied with the

NYSE corporate governance listing standards.

Design: VSA Partners, New York Photos: Chris Buck, Michael Hemberger, Corbis, Getty Images, Veer Inc. Printing: ADP Graphic Communications Printed on 30% post-consumer recycled paper.