ADT 2005 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

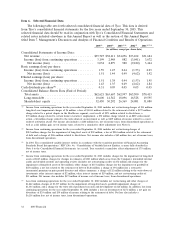

Net revenue increased $4.2 billion, or 12.1%, for 2004 as compared to 2003, which resulted from

growth in all segments. Foreign currency exchange rates favorably affected the period by $1.7 billion

while the impact of divestitures negatively impacted the period by $638 million.

Operating income increased $2.4 billion, or 82.0%, for 2004 while operating margin increased

5.2 percentage points to 13.6%. Operating income for 2004 was unfavorably impacted by charges of

$380 million, consisting of the following: (i) net restructuring and other charges of $212 million, of

which charges of $6 million are included in cost of sales; (ii) net losses and impairments on divestitures

totaling $116 million; and (iii) charges for the impairment of long-lived assets of $52 million, of which

$34 million is attributable to machinery and equipment impairments at Fire and Security. Foreign

currency exchange rates favorably affected operating income by $230 million.

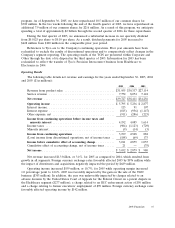

Operating income for 2003 was unfavorably impacted by net charges totaling $1,625 million. These

charges consisted of: (i) charges for the impairment of long-lived assets of $815 million; (ii) charges

recorded for changes in estimates of $298 million which arose from the Company’s intensified internal

audits and detailed controls and operating reviews (includes net restructuring credits of $72 million, of

which credits of $13 million are included in costs of sales, charges for the impairment of long-lived

assets of $10 million, charges of $240 million included in selling, general and administrative expenses,

and charges of $120 million included in cost of sales); (iii) charges for the impairment of goodwill of

$278 million; (iv) other charges of $154 million, of which $34 million is included in cost of sales related

primarily to product warranty reserves and the dismantlement of customers’ ADT security systems, and

$120 million is included in selling, general and administrative expenses related primarily to uncollectible

accounts receivable, internal investigation fees, as well as severance and facility closures, slightly offset

by a credit for changes in estimates of charges recorded in prior periods; (v) a charge of $91 million for

a retroactive, incremental premium on prior period directors and officers insurance included in selling,

general and administrative expenses; and (vi) net restructuring credits of $11 million, of which charges

of $2 million are included in cost of sales. Foreign currency exchange rates favorably affected operating

income by $191 million.

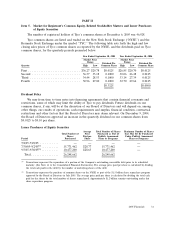

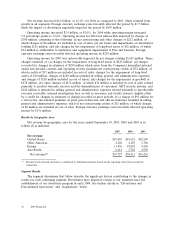

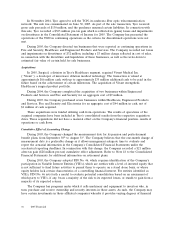

Results by Geographic Area

Net revenue by geographic area for the years ended September 30, 2005, 2004 and 2003 is as

follows ($ in millions):

2005 2004 2003

Net revenue:

United States ..................................... $19,635 $19,632 $18,309

Other Americas ................................... 2,202 2,103 1,786

Europe .......................................... 11,476 10,892 9,256

Asia-Pacific ...................................... 6,414 5,784 4,905

Net revenue(1) ................................... $39,727 $38,411 $34,256

(1) Revenue from external customers is attributed to individual countries based on the reporting entity that records the

transaction.

Segment Results

The segment discussions that follow describe the significant factors contributing to the changes in

results for each continuing segment. Divestitures have impacted certain of our segments since the

establishment of our divestiture program in early 2004. See further details in ‘‘Divestitures and

Discontinued Operations’’ and ‘‘Acquisitions’’ below.

36 2005 Financials