ADT 2005 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2005 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In November 2004, Tyco agreed to sell the TGN, its undersea fiber optic telecommunication

network. The sale was consummated on June 30, 2005. As part of the sale transaction, Tyco received

gross cash proceeds of $130 million, and the purchaser assumed certain liabilities. In connection with

this sale, Tyco recorded a $303 million pre-tax gain which is reflected in (gains) losses and impairments

on divestitures in the Consolidated Statement of Income for 2005. The Company has presented the

operations of the TGN in continuing operations as the criteria for discontinued operations were not

met.

During 2005, the Company divested ten businesses that were reported as continuing operations in

Fire and Security, Healthcare and Engineered Products and Services. The Company recorded net losses

and impairments on divestitures of $32 million, including a $3 million charge reflected in cost of sales,

in connection with the divestiture and liquidation of these businesses, as well as the write-down to

estimated fair value of certain held for sale businesses.

Acquisitions

In 2005, Surgical, a division in Tyco’s Healthcare segment, acquired Vivant Medical Inc.

(‘‘Vivant’’), a developer of microwave ablation medical technology. The transaction is valued at

approximately $66 million cash, with up to approximately $35 million additional cash to be paid in the

future based on the achievement of certain milestones. The acquisition of Vivant strengthens

Healthcare’s surgical product portfolio.

During 2004, the Company completed the acquisition of two businesses within Engineered

Products and Services and Fire and Security for an aggregate cost of $9 million.

During 2003, the Company purchased seven businesses within Healthcare, Engineered Products

and Services, Fire and Security and Electronics for an aggregate cost of $44 million in cash, net of

$1 million of cash acquired.

These acquisitions were funded utilizing cash from operations. The results of operations of the

acquired companies have been included in Tyco’s consolidated results from the respective acquisition

dates. These acquisitions did not have a material effect on the Company’s financial position, results of

operations or cash flows.

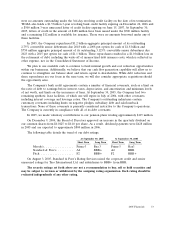

Cumulative Effect of Accounting Change

During 2005, the Company changed the measurement date for its pension and postretirement

benefit plans, from September 30th to August 31st. The Company believes that the one-month change of

measurement date is a preferable change as it allows management adequate time to evaluate and

report the actuarial information in the Company’s Consolidated Financial Statements under the

accelerated reporting deadlines. In conjunction with this change, the Company recorded a $21 million

after-tax gain ($28 million pre-tax) cumulative effect adjustment. Refer to Note 18 to the Consolidated

Financial Statements for additional information on retirement plans.

During 2003, the Company adopted FIN No. 46, which requires identification of the Company’s

participation in Variable Interest Entities (VIE’s), which are entities with a level of invested equity that

is not sufficient to fund future activities to permit them to operate on a stand alone basis, or whose

equity holders lack certain characteristics of a controlling financial interest. For entities identified as

VIE’s, FIN No. 46 sets forth a model to evaluate potential consolidation based on an assessment of

which party to VIE’s, if any, bears a majority of the risk to its expected losses, or stands to gain from a

majority of its expected returns.

The Company has programs under which it sells machinery and equipment to investors who, in

turn, purchase and receive ownership and security interests in those assets. As such, the Company may

have certain investments in those affiliated companies whereby it provides varying degrees of financial

46 2005 Financials