The Hartford 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.84

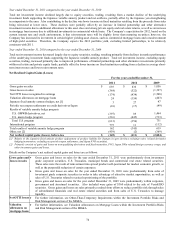

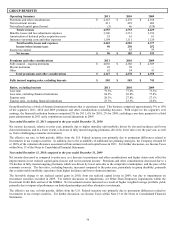

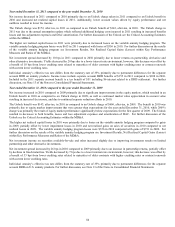

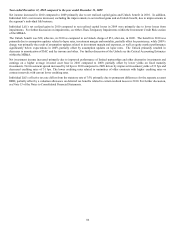

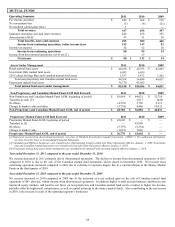

Year ended December 31, 2011 compared to the year ended December 31, 2010

Net income decreased in 2011 compared to 2010 primarily due to an Unlock charge taken in 2011 compared to an Unlock benefit in

2010 and increased net realized capital losses in 2011. Additionally, lower account values driven by equity performance and net

outflows resulted in lower fee income.

The Unlock charge was $172, after-tax, in 2011 as compared to an Unlock benefit of $143, after-tax, in 2010. The Unlock charge in

2011 was due to the annual assumption update which reflected additional hedging costs incurred in 2011 resulting in increased benefits

losses and loss adjustment expenses and DAC amortization. For further discussion of the Unlock see the Critical Accounting Estimates

within the MD&A.

The higher net realized capital losses in 2011 were primarily due to increased losses on the variable annuity hedging program. The

variable annuity hedging program losses were $613 in 2011 compared with losses of $356 in 2010. For further discussion on the results

of the variable annuity hedging program see Investment Results, Net Realized Capital Gains (Losses) within Key Performance

Measures and Ratios of the MD&A.

Net investment spread decreased by 10 bps in 2011 compared to 2010 primarily due to lower returns on partnership, derivative and

other alternative investments. Yields decreased by 28 bps due to a lower interest rate environment, however, this decrease was offset by

a benefit of 18 bps from lower crediting rates related to maturities of older contracts with higher crediting rates or contract renewals

with current lower crediting rates.

Individual Annuity’ s effective tax rate differs from the statutory rate of 35% primarily due to permanent differences for the separate

account DRD on annuity products. Income taxes include separate account DRD benefits of $155 in 2011 compared to $108 in 2010.

Included in the 2011 separate account benefit is a tax benefit of $51 including $6 interest related to a DRD settlement. For further

discussion, see Note 13 of the Notes to Consolidated Financial Statements.

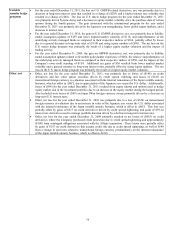

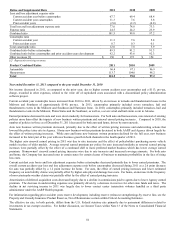

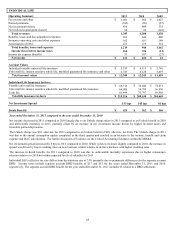

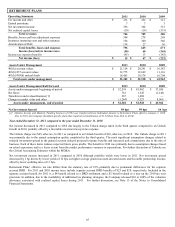

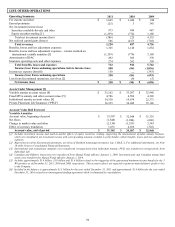

Year ended December 31, 2010 compared to the year ended December 31, 2009

Net income increased in 2010 compared to 2009 primarily due to significant improvements in the equity markets, which resulted in an

Unlock benefit in 2010 as compared to an Unlock charge in 2009, as well as continued market value appreciation in account value

resulting in increased fee income, and due to continued expense reduction efforts in 2010.

The Unlock benefit was $143, after-tax, in 2010 as compared to an Unlock charge of $606, after-tax, in 2009. The benefit in 2010 was

primarily due to equity market improvements that were greater than expectations for the year ended December 31, 2010, while 2009’ s

charge was primarily the result of equity market performance significantly below expectations for the first quarter of 2009. The Unlock

resulted in decreases to both benefits, losses and loss adjustment expenses and amortization of DAC. For further discussion of the

Unlock see the Critical Accounting Estimates within the MD&A.

The higher net realized capital losses in 2010 were primarily due to losses on the variable annuity hedging program compared to gains

in 2009, partially offset by lower impairment losses in 2010 and net realized gains on sales of securities in 2010 compared to net

realized losses in 2009. The variable annuity hedging program losses were $356 in 2010 compared with gains of $731 in 2009. For

further discussion on the results of the variable annuity hedging program see Investment Results, Net Realized Capital Gains (Losses)

within Key Performance Measures and Ratios of the MD&A.

Net investment income on securities available-for-sale and other increased slightly due to improving investments results on limited

partnership and other alternative investments.

Net investment spread increased by 26 bps in 2010 compared to 2009 primarily due to an increase in partnership returns, partially offset

by declines in fixed maturities. Yields decreased by 7 bps due to a lower interest rate environment, however, this decrease was offset by

a benefit of 33 bps from lower crediting rates related to maturities of older contracts with higher crediting rates or contract renewals

with current lower crediting rates.

Individual Annuity’ s effective tax rate differs from the statutory rate of 35% primarily due to permanent differences for the separate

account DRD on U.S. annuity products. For further discussion, see Note 13 of the Notes to Consolidated Financial Statements.