The Hartford 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

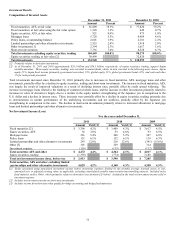

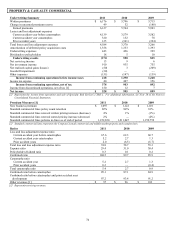

Return on Assets

Return on assets is a key indicator of overall profitability for the Individual Annuity, Retirement Plans, Mutual Funds and Life Other

Operations reporting segments as a significant portion of their earnings is based on average assets under management.

[1] Proprietary mutual funds, Investment-Only mutual funds, Canadian mutual funds, and 529 college savings plans are reported in Mutual Funds in

2011 and 2010. Prior to 2010, proprietary mutual fund assets were included in Individual Annuity, Retirement Plans, and Mutual Funds, as those

same assets generate earnings for each of these segments.

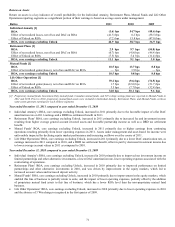

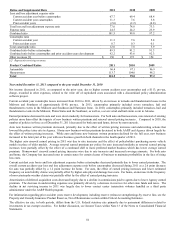

Year ended December 31, 2011 compared to year ended December 31, 2010

• Individual Annuity’ s ROA, core earnings excluding Unlock, increased in 2011 primarily due to the favorable impact of a flat DAC

amortization rate on 2011 earnings and a DRD tax settlement benefit in 2011.

• Retirement Plans’ ROA, core earnings excluding Unlock, increased in 2011 primarily due to increased fee and investment income

resulting from higher average general account invested assets and favorable partnership income as well as a DRD tax settlement

benefit.

• Mutual Funds’ ROA, core earnings excluding Unlock, increased in 2011 primarily due to higher earnings from continuing

operations resulting primarily from lower operating expenses in 2011. Assets under management and asset-based fee income were

unfavorably impacted by declining equity market performance and increasing outflows over the course of 2011.

• Life Other Operations’ ROA, core earnings excluding Unlock, increased in 2011 primarily due to a lower DAC amortization rate, as

earnings increased in 2011 compared to 2010, and a DRD tax settlement benefit, offset in part by decreased investment income due

to lower average account values in 2011 as compared to 2010.

Year ended December 31, 2010 compared to year ended December 31, 2009

• Individual Annuity’ s ROA, core earnings excluding Unlock, increased in 2010 primarily due to improved net investment income on

limited partnerships and other alternative investments, a lower DAC amortization rate, lower operating expenses associated with the

restructuring of operations.

• Retirement Plans’ ROA, core earnings excluding Unlock, increased in 2010 primarily due to improved performance on limited

partnerships and other alternative investments in 2010, and was driven by improvement in the equity markets, which led to

increased account values and increased deposit activity.

• Mutual Funds’ ROA, core earnings excluding Unlock, increased in 2010 primarily due to improvement in the equity markets, which

enabled this line of business to partially return to scale, and the impact of lower operating expenses, partially offset by the addition

of proprietary mutual fund assets to this line of business, which has a lower ROA level than the non-proprietary mutual fund

business.

• Life Other Operations’ ROA, core earnings excluding Unlock, increased in 2010 primarily due to lower operating expenses in 2010

and the absence of 3 Win charges recognized in the first quarter of 2009.

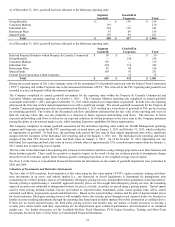

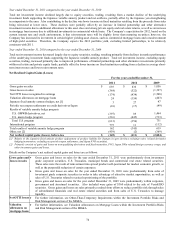

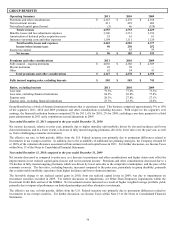

Ratios

2011

2010

2009

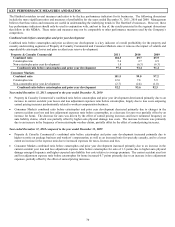

Individual Annuity [1]

ROA

(1.6) bps

54.7 bps

(48.6) bps

Effect of net realized losses, net of tax and DAC on ROA

(41.3) bps

0.2 bps

(38.5) bps

Effect of Unlock on ROA

(7.2) bps

15.8 bps

(47.0) bps

ROA, core earnings excluding Unlock

46.9 bps

38.7 bps

36.9 bps

Retirement Plans [1]

ROA

2.9 bps

9.7 bps

(54.8) bps

Effect of net realized losses, net of tax and DAC on ROA

(0.7) bps

(4.8) bps

(46.4) bps

Effect of Unlock on ROA

(7.5) bps

5.4 bps

(11.4) bps

ROA, core earnings excluding Unlock

11.1 bps

9.1 bps

3.0 bps

Mutual Funds [1]

ROA

10.5 bps

13.7 bps

8.8 bps

Effect of net realized gains/(losses), net of tax and DAC on ROA

— bps

3.9 bps

— bps

ROA, core earnings excluding Unlock

10.5 bps

9.8 bps

8.8 bps

Life Other Operations [1]

ROA

39.2 bps

(9.6) bps

(74.5) bps

Effect of net realized gains/(losses), net of tax and DAC on ROA

1.7 bps

(32.0) bps

(51.7) bps

Effect of Unlock on ROA

3.5 bps

(7.7) bps

(32.4) bps

ROA, core earnings excluding Unlock

34.0 bps

30.1 bps

9.6 bps