The Hartford 2011 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-42

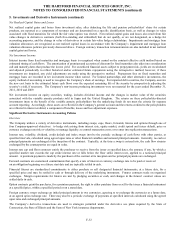

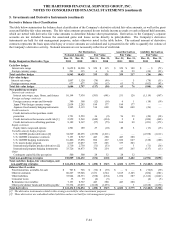

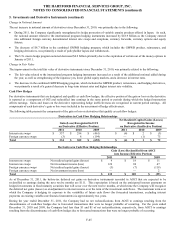

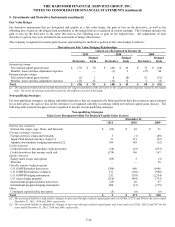

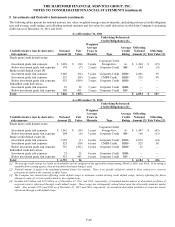

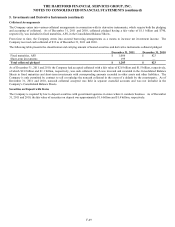

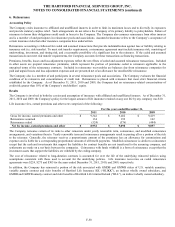

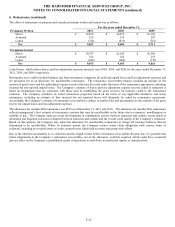

5. Investments and Derivative Instruments (continued)

Non-qualifying strategies

Interest rate swaps, swaptions, caps, floors, and futures

The Company uses interest rate swaps, swaptions, caps, floors, and futures to manage duration between assets and liabilities in certain

investment portfolios. In addition, the Company enters into interest rate swaps to terminate existing swaps, thereby offsetting the

changes in value of the original swap. As of December 31, 2011 and 2010, the notional amount of interest rate swaps in offsetting

relationships was $7.8 billion and $7.1 billion, respectively.

Foreign currency swaps and forwards

The Company enters into foreign currency swaps and forwards to convert the foreign currency exposures of certain foreign currency-

denominated fixed maturity investments to U.S. dollars.

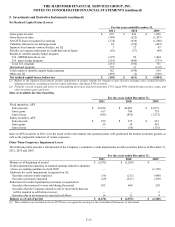

Japan 3Win foreign currency swaps

Prior to the second quarter of 2009, The Company offered certain variable annuity products with a GMIB rider through a wholly-owned

Japanese subsidiary. The GMIB rider is reinsured to a wholly-owned U.S. subsidiary, which invests in U.S. dollar denominated assets

to support the liability. The U.S. subsidiary entered into pay U.S. dollar, receive yen swap contracts to hedge the currency and interest

rate exposure between the U.S. dollar denominated assets and the yen denominated fixed liability reinsurance payments.

Japanese fixed annuity hedging instruments

Prior to the second quarter of 2009, The Company offered a yen denominated fixed annuity product through a wholly-owned Japanese

subsidiary and reinsured to a wholly-owned U.S. subsidiary. The U.S. subsidiary invests in U.S. dollar denominated securities to

support the yen denominated fixed liability payments and entered into currency rate swaps to hedge the foreign currency exchange rate

and yen interest rate exposures that exist as a result of U.S. dollar assets backing the yen denominated liability.

Credit derivatives that purchase credit protection

Credit default swaps are used to purchase credit protection on an individual entity or referenced index to economically hedge against

default risk and credit-related changes in value on fixed maturity securities. These contracts require the Company to pay a periodic fee

in exchange for compensation from the counterparty should the referenced security issuers experience a credit event, as defined in the

contract.

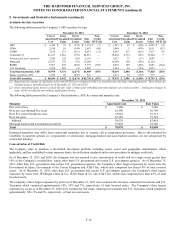

Credit derivatives that assume credit risk

Credit default swaps are used to assume credit risk related to an individual entity, referenced index, or asset pool, as a part of replication

transactions. These contracts entitle the Company to receive a periodic fee in exchange for an obligation to compensate the derivative

counterparty should the referenced security issuers experience a credit event, as defined in the contract. The Company is also exposed

to credit risk due to credit derivatives embedded within certain fixed maturity securities. These securities are primarily comprised of

structured securities that contain credit derivatives that reference a standard index of corporate securities.

Credit derivatives in offsetting positions

The Company enters into credit default swaps to terminate existing credit default swaps, thereby offsetting the changes in value of the

original swap going forward.

Equity index swaps and options

The Company offers certain equity indexed products, which may contain an embedded derivative that requires bifurcation. The

Company enters into S&P index swaps and options to economically hedge the equity volatility risk associated with these embedded

derivatives. In addition, during the third quarter of 2011, the Company entered into equity index options and futures with the purpose of

hedging the impact of an adverse equity market environment on the investment portfolio.

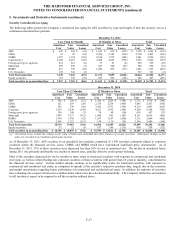

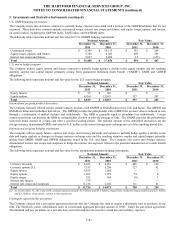

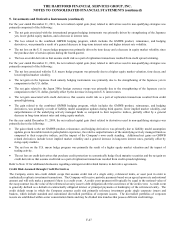

U.S GMWB product derivatives

The Company offers certain variable annuity products with a GMWB rider in the U.S. The GMWB is a bifurcated embedded derivative

that provides the policyholder with a guaranteed remaining balance (“GRB”) if the account value is reduced to zero through a

combination of market declines and withdrawals. The GRB is generally equal to premiums less withdrawals. Certain contract

provisions can increase the GRB at contractholder election or after the passage of time. The notional value of the embedded derivative

is the GRB.

U.S. GMWB reinsurance contracts

The Company has entered into reinsurance arrangements to offset a portion of its risk exposure to the GMWB for the remaining lives of

covered variable annuity contracts. Reinsurance contracts covering GMWB are accounted for as free-standing derivatives. The

notional amount of the reinsurance contracts is the GRB amount.