The Hartford 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

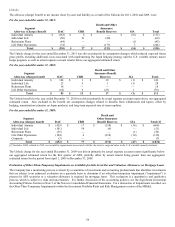

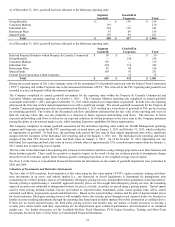

Unlocks

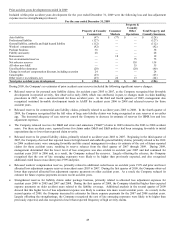

The after-tax (charge) benefit to net income (loss) by asset and liability as a result of the Unlocks for 2011, 2010 and 2009, were:

For the year ended December 31, 2011:

Segment

After-tax (Charge) Benefit

DAC

URR

Death and Other

Insurance

Benefit Reserves

SIA

Total

Individual Annuity

$

(162)

$

6

$

—

$

(16)

$

(172)

Individual Life

(50)

21

(40)

—

(69)

Retirement Plans

(44)

—

—

(1)

(45)

Life Other Operations

(74)

—

(173)

3

(244)

Total

$

(330)

$

27

$

(213)

$

(14)

$

(530)

The Unlock charge for the year ended December 31, 2011 was driven primarily by assumption changes which reduced expected future

gross profits including additional costs associated with implementing the Japan hedging strategy and the U.S. variable annuity macro

hedge program, as well as actual separate account returns below our aggregated estimated return.

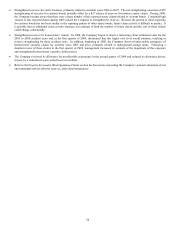

For the year ended December 31, 2010:

Segment

After-tax (charge) benefit

DAC

URR

Death and Other

Insurance Benefit

Reserves

SIA

Total

Individual Annuity

$

104

$

1

$

39

$

(1)

$

143

Individual Life

23

5

1

(1)

28

Retirement Plans

18

—

—

—

18

Life Other Operations

(62)

6

(23)

1

(78)

Total

$

83

$

12

$

17

$

(1)

$

111

The Unlock benefit for the year ended December 31, 2010 was driven primarily by actual separate account returns above our aggregated

estimated return. Also included in the benefit are assumption changes related to benefits from withdrawals and lapses, offset by

hedging, annuitization estimates on Japan products, and long-term expected rate of return updates.

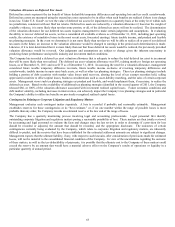

For the year ended December 31, 2009:

Segment

After-tax (charge) benefit

DAC

URR

Death and

Other Insurance

Benefit Reserves

SIA

Total [1]

Individual Annuity

$

(429)

$

17

$

(158)

$

(36)

$

(606)

Individual Life

(101)

54

(4)

—

(51)

Retirement Plans

(55)

—

—

(1)

(56)

Life Other Operations

(104)

6

(210)

(10)

(318)

Corporate

(3)

—

—

—

(3)

Total

$

(692)

$

77

$

(372)

$

(47)

$

(1,034)

[1] Includes $(49) related to DAC recoverability impairment associated with the decision to suspend sales in the U.K variable annuity business.

The Unlock charge for the year ended December 31, 2009 was driven primarily by actual separate account returns significantly below

our aggregated estimated return for the first quarter of 2009, partially offset by actual returns being greater than our aggregated

estimated return for the period from April 1, 2009 to December 31, 2009.

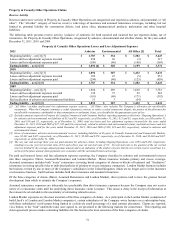

Evaluation of Other-Than-Temporary Impairments on Available-for-Sale Securities and Valuation Allowances on Mortgage Loans

The Company has a monitoring process overseen by a committee of investment and accounting professionals that identifies investments

that are subject to an enhanced evaluation on a quarterly basis to determine if an other-than-temporary impairment (“impairment”) is

present for AFS securities or a valuation allowance is required for mortgage loans. This evaluation is a quantitative and qualitative

process, which is subject to risks and uncertainties. For further discussion of the accounting policies, see the Significant Investment

Accounting Policies Section in Note 5 of the Notes to Consolidated Financial Statements. For a discussion of impairments recorded, see

the Other-Than-Temporary Impairments within the Investment Portfolio Risks and Risk Management section of the MD&A.