The Hartford 2011 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-28

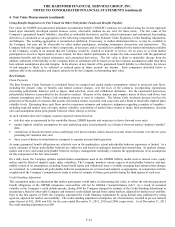

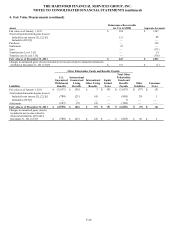

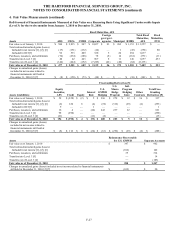

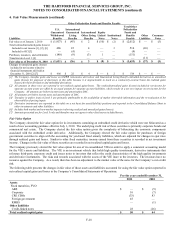

4. Fair Value Measurements (continued)

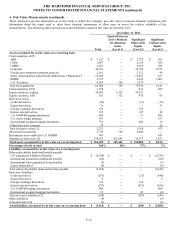

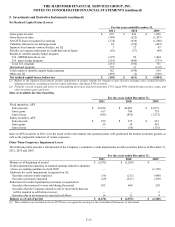

Other Policyholder Funds and Benefits Payable

Liabilities

U.S.

Guaranteed

Withdrawal

Benefits

International

Guaranteed

Living

Benefits

Int

ernational

Other Living

Benefits

Equity

Linked

Notes

Institutional

Notes

Total Other

Policyholder

Funds and

Benefits

Payable

Other

Liabilities

Consumer

Notes

Fair value as of January 1, 2010

$

(1,957)

$

(45)

$

2

$

(10)

$

(2)

$

(2,012)

$

—

$

(5)

Total realized/unrealized gains (losses)

Included in net income [1], [2], [6]

486

22

4

—

2

514

(26)

—

Included in OCI [3]

—

(4)

—

—

—

(4)

—

—

Purchases, issuances, and settlements

(140)

(9)

(3)

1

—

(151)

—

—

Transfers into Level 3 [4]

—

—

—

—

—

—

(11)

—

Fair value as of December 31, 2010 $

(1,611)

$

(36)

$

3

$

(9)

$

—

$

(1,653)

$

(37)

$

(5)

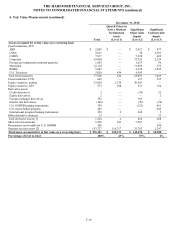

Changes in unrealized gains (losses)

included in net income related to

financial instruments still held at

December 31, 2010 [2] [7]

$

486

$

22

$

4

$

—

$

2

$

514

$

—

$

—

[1] The Company classifies gains and losses on GMWB reinsurance derivatives and Guaranteed Living Benefit embedded derivatives as unrealized

gains (losses) for purposes of disclosure in this table because it is impracticable to track on a contract-by-contract basis the realized gains

(losses) for these derivatives and embedded derivatives.

[2] All amounts in these rows are reported in net realized capital gains/losses. The realized/unrealized gains (losses) included in net income for

separate account assets are offset by an equal amount for separate account liabilities, which results in a net zero impact on net income for the

Company. All amounts are before income taxes and amortization DAC.

[3] All amounts are before income taxes and amortization of DAC.

[4] Transfers in and/or (out) of Level 3 are primarily attributable to the availability of market observable information and the re-evaluation of the

observability of pricing inputs.

[5] Derivative instruments are reported in this table on a net basis for asset/(liability) positions and reported in the Consolidated Balance Sheet in

other investments and other liabilities.

[6] Includes both market and non-market impacts in deriving realized and unrealized gains (losses).

[7] Amounts presented are for Level 3 only and therefore may not agree to other disclosures included herein.

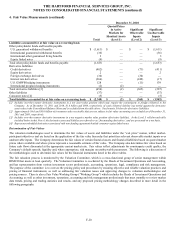

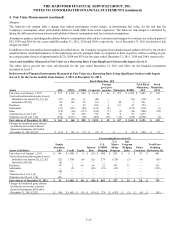

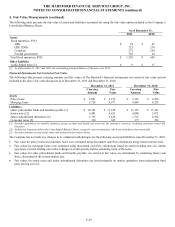

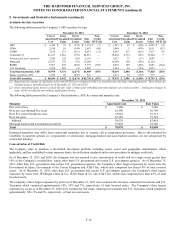

Fair Value Option

The Company elected the fair value option for its investments containing an embedded credit derivative which were not bifurcated as a

result of new accounting guidance effective July 1, 2010. The underlying credit risk of these securities is primarily corporate bonds and

commercial real estate. The Company elected the fair value option given the complexity of bifurcating the economic components

associated with the embedded credit derivative. Additionally, the Company elected the fair value option for purchases of foreign

government securities to align with the accounting for yen-based fixed annuity liabilities, which are adjusted for changes in spot rates

through realized gains and losses. Similar to other fixed maturities, income earned from these securities is recorded in net investment

income. Changes in the fair value of these securities are recorded in net realized capital gains and losses.

The Company previously elected the fair value option for one of its consolidated VIEs in order to apply a consistent accounting model

for the VIE’ s assets and liabilities. The VIE is an investment vehicle that holds high quality investments, derivative instruments that

reference third-party corporate credit and issues notes to investors that reflect the credit characteristics of the high quality investments

and derivative instruments. The risks and rewards associated with the assets of the VIE inure to the investors. The investors have no

recourse against the Company. As a result, there has been no adjustment to the market value of the notes for the Company’ s own credit

risk.

The following table presents the changes in fair value of those assets and liabilities accounted for using the fair value option reported in

net realized capital gains and losses in the Company’ s Consolidated Statements of Operations.

For the years ended December 31,

2011

2010

Assets

Fixed maturities, FVO

ABS

$

—

$

(5)

Corporate

10

(7)

CRE CDOs

(33)

83

Foreign government

45

—

RMBS

—

(1)

Other liabilities

Credit-linked notes

28

(26)

Total realized capital gains

$

50

$

44