The Hartford 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

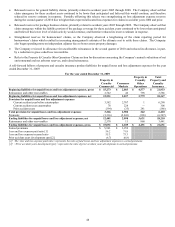

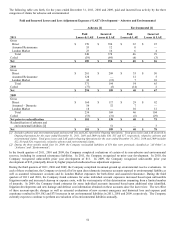

Estimated Gross Profits Used in the Valuation and Amortization of Assets and Liabilities Associated with Variable Annuity and

Other Universal Life-Type Contracts

Estimated gross profits (“EGPs”) are used in the amortization of: the DAC asset, which includes the present value of future profits; sales

inducement assets (“SIA”); and unearned revenue reserves (“URR”). See Note 7 of the Notes to Consolidated Financial Statements for

additional information on DAC. See Note 10 of the Notes to Consolidated Financial Statements for additional information on SIA.

Portions of EGPs are also used in the valuation of reserves for death and other insurance benefit features on variable annuity and

universal life-type contracts. See Note 9 of the Notes to Consolidated Financial Statements for additional information on death and

other insurance benefit reserves.

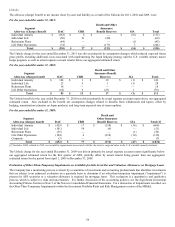

The most significant EGP based balances as of December 31, 2011 and 2010 are as follows:

Individual Annuity

Individual Life

Retirement Plans

Life Other Operations

2011

2010

2011

2010

2011

2010

2011

2010

DAC

$

2,815

$

3,251

$

2,755

$

2,633

$

813

$

820

$

1,256

$

1,652

SIA

$

291

$

329

$

47

$

45

$

22

$

23

$

54

$

41

URR

$

90

$

99

$

1,570

$

1,367

$

—

$

—

$

39

$

59

Death and Other

Insurance

Benefit Reserves

$

1,103

$

1,052

$

228

$

113

$

1

$

1

$

975

$

696

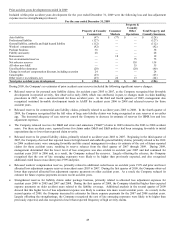

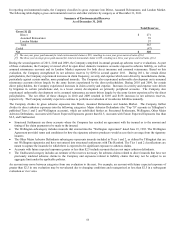

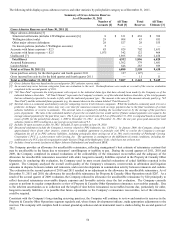

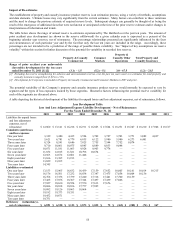

For most contracts, the Company estimates gross profits over 20 years as EGPs emerging subsequent to that timeframe are immaterial.

Products sold in a particular year are aggregated into cohorts. Future gross profits for each cohort are projected over the estimated lives

of the underlying contracts, based on future account value projections for variable annuity and variable universal life products. The

projection of future account values requires the use of certain assumptions including: separate account returns; separate account fund

mix; fees assessed against the contract holder’ s account balance; surrender and lapse rates; interest margin; mortality; and the extent and

duration of hedging activities and hedging costs. Changes in these assumptions and, in addition, changes to other policyholder behavior

assumptions such as resets, partial surrenders, reaction to price increases, and asset allocations causes EGPs to fluctuate which impacts

earnings.

The Company determines EGPs from a single deterministic reversion to mean (“RTM”) separate account return projection which is an

estimation technique commonly used by insurance entities to project future separate account returns. Through this estimation

technique, the Company’ s DAC model is adjusted to reflect actual account values at the end of each quarter. Through consideration of

recent market returns, the Company will unlock, or adjust, projected returns over a future period so that the account value returns to the

long-term expected rate of return, providing that those projected returns do not exceed certain caps or floors. This Unlock for future

separate account returns is determined each quarter. Under RTM, the expected long term weighted average rate of return is 8.3% and

5.9% for U.S. and Japan, respectively.

In the third quarter of each year, the Company completes a comprehensive non-market related policyholder behavior assumption study

and incorporates the results of those studies into its projection of future gross profits. Additionally, throughout the year, the Company

evaluates various aspects of policyholder behavior and periodically revises its policyholder assumptions as credible emerging data

indicates that changes are warranted. Upon completion of the assumption study or evaluation of credible new information, the

Company will revise its assumptions to reflect its current best estimate. These assumption revisions will change the projected account

values and the related EGPs in the DAC, SIA and URR amortization models, as well as the death and other insurance benefit reserving

model.

All assumption changes that affect the estimate of future EGPs including the update of current account values, the use of the RTM

estimation technique and policyholder behavior assumptions are considered an Unlock in the period of revision. An Unlock adjusts

DAC, SIA, URR and death and other insurance benefit reserve balances in the Consolidated Balance Sheets with an offsetting benefit or

charge in the Consolidated Statements of Operations in the period of the revision. An Unlock that results in an after-tax benefit

generally occurs as a result of actual experience or future expectations of product profitability being favorable compared to previous

estimates. An Unlock that results in an after-tax charge generally occurs as a result of actual experience or future expectations of

product profitability being unfavorable compared to previous estimates.

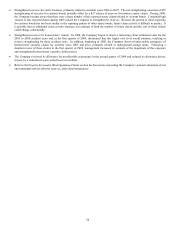

EGPs are also used to determine the expected excess benefits and assessments included in the measurement of death and other insurance

benefit reserves. These excess benefits and assessments are derived from a range of stochastic scenarios that have been calibrated to the

Company’ s RTM separate account returns. The determination of death and other insurance benefit reserves is also impacted by discount

rates, lapses, volatilities, mortality assumptions and benefit utilization, including assumptions around annuitization rates.

An Unlock revises EGPs, on a quarterly basis, to reflect market updates of policyholder account value and the Company's current best

estimate assumptions. Modifications to the Company’ s hedging programs may impact EGPs, and correspondingly impact DAC

recoverability. After each quarterly Unlock, the Company also tests the aggregate recoverability of DAC by comparing the DAC

balance to the present value of future EGPs. The margin between the DAC balance and the present value of future EGPs for U.S. and

Japan individual variable annuities was 23% and 40% as of December 31, 2011, respectively. If the margin between the DAC asset and

the present value of future EGPs is exhausted, then further reductions in EGPs would cause portions of DAC to be unrecoverable and

the DAC asset would be written down to equal future EGPs.