The Hartford 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

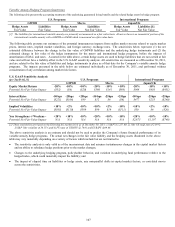

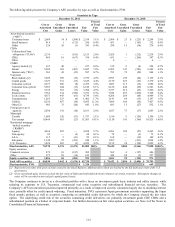

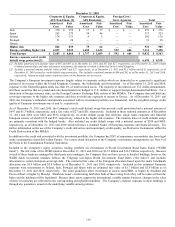

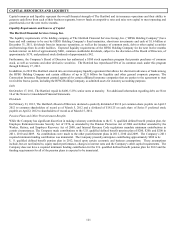

December 31, 2010

AAA AA A BBB BB and Below Total

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

2003 & Prior

$

782

$

803

$

146

$

142

$

107

$

103

$

24

$

21

$

26

$

22

$

1,085

$

1,091

2004

489

511

35

35

68

61

33

27

6

5

631

639

2005 610 632 131 121 213 177 182 147 123 96 1,259 1,173

2006

1,016

1,050

566

536

256

224

496

416

436

339

2,770

2,565

2007

305

320

278

250

71

55

253

200

278

198

1,185

1,023

2008

55

58

—

—

—

—

—

—

—

—

55

58

Total

$

3,257

$

3,374

$

1,156

$

1,084

$

715

$

620

$

988

$

811

$

869

$

660

$

6,985

$

6,549

Credit

protection

28.8%

22.5%

13.3%

13.8%

8.0%

21.5%

[1] The vintage year represents the year the pool of loans was originated.

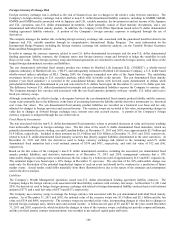

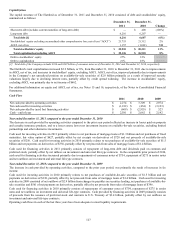

The Company also has AFS exposure to commercial real estate (“CRE”) collateralized debt obligations (“CDOs”) with an amortized

cost and fair value of $485 and $334, respectively, as of December 31, 2011 and $653 and $387, respectively, as of December 31, 2010.

These securities are comprised of diversified pools of commercial mortgage loans or equity positions of other CMBS securitizations.

Although the Company does not plan to invest in this asset class going forward, we continue to monitor these investments as economic

and market uncertainties regarding future performance impacts market liquidity and results in higher risk premiums.

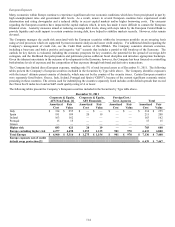

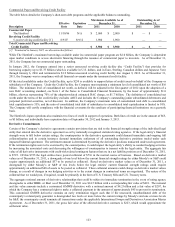

In addition to CMBS bonds and CRE CDOs, the Company has exposure to commercial mortgage loans as presented in the following

table. These loans are collateralized by a variety of commercial properties and are diversified both geographically throughout the

United States and by property type. These loans may be either in the form of a whole loan, where the Company is the sole lender, or a

loan participation. Loan participations are loans where the Company has purchased or retained a portion of an outstanding loan or

package of loans and participates on a pro-rata basis in collecting interest and principal pursuant to the terms of the participation

agreement. In general, A-Note participations have senior payment priority, followed by B-Note participations and then mezzanine loan

participations. As of December 31, 2011, loans within the Company’ s mortgage loan portfolio that have had extensions or

restructurings other than what is allowable under the original terms of the contract are immaterial.

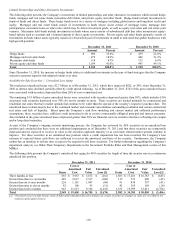

Commercial Mortgage Loans

December 31, 2011

December 31, 2010

Amortized

Cost [1]

Valuation

Allowance

Carrying

Value

Amortized

Cost [1]

Valuation

Allowance

Carrying

Value

Agricultural

$

268

$

(19)

$

249

$

339

$

(23)

$

316

Whole loans

4,892

(17)

4,875

3,326

(23)

3,303

A-Note participations

265

—

265

319

—

319

B-Note participations

296

(66)

230

327

(70)

257

Mezzanine loans

109

—

109

181

(36)

145

Total

$

5,830

$

(102)

$

5,728

$

4,492

$

(152)

$

4,340

[1] Amortized cost represents carrying value prior to valuation allowances, if any.

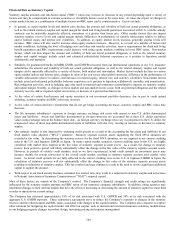

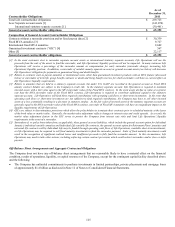

Since December 31, 2010, the Company funded $1.8 billion of commercial whole loans with a weighted average loan-to-value (“LTV”)

ratio of 62% and a weighted average yield of 4.5%. The Company continues to originate commercial whole loans in primary markets,

such as multi-family and retail, focusing on loans with strong LTV ratios and high quality property collateral. As of December 31,

2011, the Company had mortgage loans held-for-sale with a carrying value and valuation allowance of $74 and $4, respectively, and $87

and $7, respectively, as of December 31, 2010.

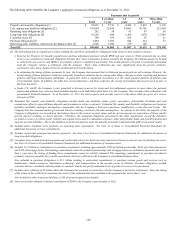

Municipal Bonds

The Company holds investments in securities backed by states, municipalities and political subdivisions (“municipal”) with an

amortized cost and fair value of $12.6 billion and $13.3 billion, respectively, as of December 31, 2011 and $12.5 billion and $12.1

billion, respectively, as of December 31, 2010. The Company’ s municipal bond portfolio primarily consists of high quality essential

service revenue and general obligation bonds. As of December 31, 2011, the largest issuer concentrations were the states of California,

Massachusetts and Illinois, which each comprised less than 3% of the municipal bond portfolio and were primarily comprised of general

obligation bonds. As of December 31, 2010, the largest issuer concentrations were the states of California, Massachusetts and Georgia,

which each comprised less than 3% of the municipal bond portfolio and were primarily comprised of general obligation bonds.