The Hartford 2011 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-44

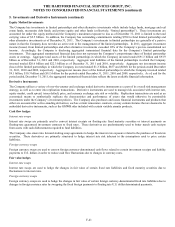

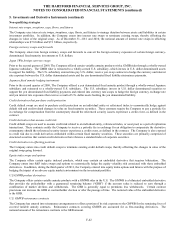

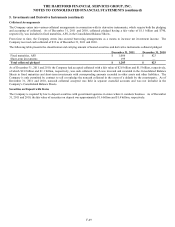

5. Investments and Derivative Instruments (continued)

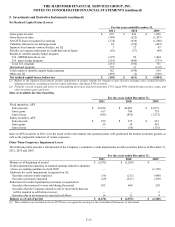

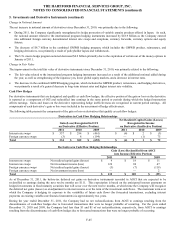

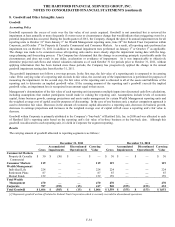

Derivative Balance Sheet Classification

The table below summarizes the balance sheet classification of the Company’ s derivative related fair value amounts, as well as the gross

asset and liability fair value amounts. The fair value amounts presented do not include income accruals or cash collateral held amounts,

which are netted with derivative fair value amounts to determine balance sheet presentation. Derivatives in the Company’ s separate

accounts are not included because the associated gains and losses accrue directly to policyholders. The Company’ s derivative

instruments are held for risk management purposes, unless otherwise noted in the table below. The notional amount of derivative

contracts represents the basis upon which pay or receive amounts are calculated and is presented in the table to quantify the volume of

the Company’ s derivative activity. Notional amounts are not necessarily reflective of credit risk.

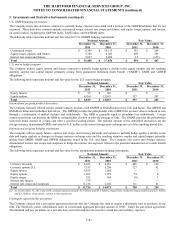

Net Derivatives

Asset Derivatives

Liability Derivatives

Notional Amount

Fair Value

Fair Value

Fair Value

Hedge Designation/ Derivative Type

Dec. 31,

2011

Dec. 31,

2010

Dec. 31,

2011

Dec. 31,

2010

Dec. 31,

2011

Dec. 31,

2010

Dec. 31,

2011

Dec. 31,

2010

Cash flow hedges

Interest rate swaps

$

8,652

$

10,290

$

329

$

115

$

329

$

188

$

—

$

(73)

Foreign currency swaps

291

335

6

6

30

29

(24)

(23)

Total cash flow hedges

8,943

10,625

335

121

359

217

(24)

(96)

Fair value hedges

Interest rate swaps

1,007

1,120

(78)

(46)

—

5

(78)

(51)

Foreign currency swaps

677

677

(39)

(12)

63

71

(102)

(83)

Total fair value hedges

1,684

1,797

(117)

(58)

63

76

(180)

(134)

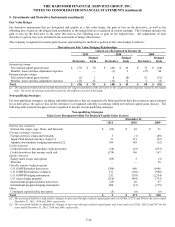

Non-qualifying strategies

Interest rate contracts

Interest rate swaps, caps, floors, and futures

10,144

7,938

(583)

(441)

531

126

(1,114)

(567)

Foreign exchange contracts

Foreign currency swaps and forwards

380

368

(12)

(18)

6

1

(18)

(19)

Japan 3Win foreign currency swaps

2,054

2,285

184

177

184

177

—

—

Japanese fixed annuity hedging instruments

1,945 2,119 514 608 540 608 (26) —

Credit contracts

Credit derivatives that purchase credit

protection 1,721 2,559 36 (9) 56 29 (20) (38)

Credit derivatives that assume credit risk [1]

2,952

2,569

(648)

(434)

2

8

(650)

(442)

Credit derivatives in offsetting positions

8,189

8,367

(57)

(75)

164

98

(221)

(173)

Equity contracts

Equity index swaps and options

1,501

189

27

(10)

40

5

(13)

(15)

Variable annuity hedge program

U.S. GMWB product derivatives [2]

34,569

40,255

(2,538)

(1,611)

—

—

(2,538)

(1,611)

U.S. GMWB reinsurance contracts

7,193

8,767

443

280

443

280

—

—

U.S. GMWB hedging instruments

16,406

17,856

894

467

1,022

647

(128)

(180)

U.S. macro hedge program

6,819

13,057

357

203

357

203

—

—

International program product derivatives [2]

2,710

2,730

(71)

(33)

—

3

(71)

(36)

International program hedging instruments

33,726

14,873

750

254

887

265

(137)

(11)

Other

Contingent capital facility put option

500

500

28

32

28

32

—

—

Total non-qualifying strategies

130,809

124,432

(676)

(610)

4,260

2,482

(4,936)

(3,092)

Total cash flow hedges, fair value hedges, and

non-qualifying strategies

$

141,436

$

136,854

$

(458)

$

(547)

$

4,682

$

2,775

$

(5,140)

$

(3,322)

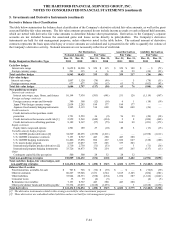

Balance Sheet Location

Fixed maturities, available-for-sale

$

703

$

728

$

(72)

$

(39)

$

—

$

—

$

(72)

$

(39)

Other investments

60,227

55,948

2,331

1,524

3,165

2,105

(834)

(581)

Other liabilities 35,944 28,333 (538) (654) 1,074 387 (1,612) (1,041)

Consumer notes

35

39

(4)

(5)

—

—

(4)

(5)

Reinsurance recoverables

7,193

8,767

443

280

443

280

—

—

Other policyholder funds and benefits payable

37,334

43,039

(2,618)

(1,653)

—

3

(2,618)

(1,656)

Total derivatives

$

141,436

$

136,854

$

(458)

$

(547)

$

4,682

$

2,775

$

(5,140)

$

(3,322)

[1] The derivative instruments related to this strategy are held for other investment purposes.

[2] These derivatives are embedded within liabilities and are not held for risk management purposes.