The Hartford 2011 Annual Report Download - page 200

Download and view the complete annual report

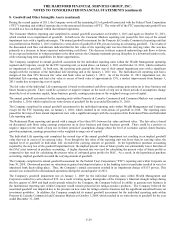

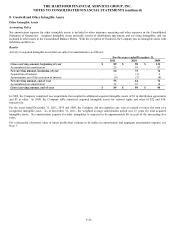

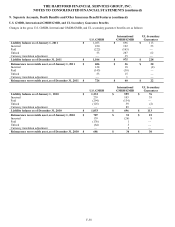

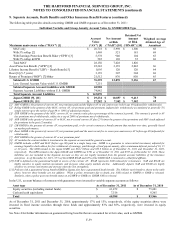

Please find page 200 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-65

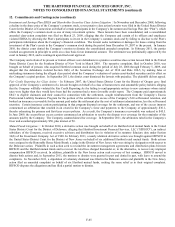

12. Commitments and Contingencies (continued)

Investment and Savings Plan ERISA and Shareholder Securities Class Action Litigation – In November and December 2008, following

a decline in the share price of the Company’ s common stock, seven putative class action lawsuits were filed in the United States District

Court for the District of Connecticut on behalf of certain participants in the Company’ s Investment and Savings Plan (the “Plan”), which

offers the Company’ s common stock as one of many investment options. These lawsuits have been consolidated, and a consolidated

amended class-action complaint was filed on March 23, 2009, alleging that the Company and certain of its officers and employees

violated ERISA by allowing the Plan’ s participants to invest in the Company’ s common stock and by failing to disclose to the Plan’ s

participants information about the Company’ s financial condition. The lawsuit seeks restitution or damages for losses arising from the

investment of the Plan’ s assets in the Company’ s common stock during the period from December 10, 2007 to the present. In January

2010, the district court denied the Company’ s motion to dismiss the consolidated amended complaint. In February 2011, the parties

reached an agreement in principle to settle on a class basis for an immaterial amount. The settlement was preliminarily approved by the

court in January 2012, and is contingent upon final court approval.

The Company and certain of its present or former officers were defendants in a putative securities class action lawsuit filed in the United

States District Court for the Southern District of New York in March 2010. The operative complaint, filed in October 2010, was

brought on behalf of persons who acquired Hartford common stock during the period of July 28, 2008 through February 5, 2009, and

alleged that the defendants violated Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5, by making false or

misleading statements during the alleged class period about the Company’ s valuation of certain asset-backed securities and its effect on

the Company’ s capital position. In September 2011, the district court dismissed the lawsuit with prejudice. The plaintiffs did not appeal.

Fair Credit Reporting Act Class Action – In February 2007, the United States District Court for the District of Oregon gave final

approval of the Company’ s settlement of a lawsuit brought on behalf of a class of homeowners and automobile policy holders alleging

that the Company willfully violated the Fair Credit Reporting Act by failing to send appropriate notices to new customers whose initial

rates were higher than they would have been had the customer had a more favorable credit report. The Company paid approximately

$84.3 to eligible claimants and their counsel in connection with the settlement, sought reimbursement from the Company’ s Excess

Professional Liability Insurance Program for the portion of the settlement in excess of the Company’ s $10 self-insured retention, and

booked an insurance recoverable for the amount paid under the settlement plus the cost of settlement administration, less the self-insured

retention. Certain insurance carriers participating in that program disputed coverage for the settlement, and one of the excess insurers

commenced an arbitration that resulted in an award in the Company’ s favor and payments to the Company of approximately $30.1,

thereby exhausting the primary and first-layer excess policies. As a result, the Company’ s insurance recoverable was reduced to $45.5.

In June 2009, the second-layer excess carriers commenced an arbitration to resolve the dispute over coverage for the remainder of the

amounts paid by the Company. The Company counterclaimed for coverage. In September 2011, the arbitrators ruled in the Company’ s

favor and awarded approximately $50, plus interest of $3.

Mutual Funds Litigation — In October 2010, a derivative action was brought on behalf of six Hartford retail mutual funds in the United

States District Court for the District of Delaware, alleging that Hartford Investment Financial Services, LLC (“HIFSCO”), an indirect

subsidiary of the Company, received excessive advisory and distribution fees in violation of its statutory fiduciary duty under Section

36(b) of the Investment Company Act of 1940. In February 2011, a nearly identical derivative action was brought against HIFSCO in

the United States District Court for the District of New Jersey on behalf of six additional Hartford retail mutual funds. Both actions

were assigned to the Honorable Renee Marie Bumb, a judge in the District of New Jersey who was sitting by designation with respect to

the Delaware action. Plaintiffs in each action seek to rescind the investment management agreements and distribution plans between

HIFSCO and the Hartford mutual funds and to recover the total fees charged thereunder or, in the alternative, to recover any improper

compensation HIFSCO received. In addition, plaintiffs in the New Jersey action seek recovery of lost earnings. HIFSCO moved to

dismiss both actions and, in September 2011, the motions to dismiss were granted in part and denied in part, with leave to amend the

complaints. In November 2011, a stipulation of voluntary dismissal was filed in the Delaware action and plaintiffs in the New Jersey

action filed an amended complaint on behalf of six Hartford mutual funds, seeking the same relief as in their original complaint.

HIFSCO disputes the allegations and has filed a partial motion to dismiss.