The Hartford 2011 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-33

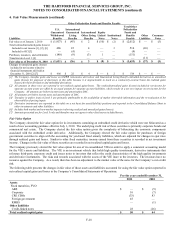

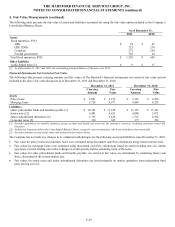

5. Investments and Derivative Instruments (continued)

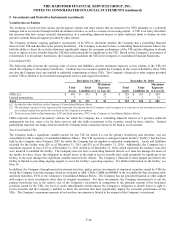

Accounting and Financial Statement Presentation of Derivative Instruments and Hedging Activities

Derivative instruments are recognized on the Consolidated Balance Sheets at fair value. For balance sheet presentation purposes, the

Company offsets the fair value amounts, income accruals, and cash collateral held, related to derivative instruments executed in a legal

entity and with the same counterparty under a master netting agreement, which provides the Company with the legal right of offset.

On the date the derivative contract is entered into, the Company designates the derivative as (1) a hedge of the fair value of a recognized

asset or liability (“fair value” hedge), (2) a hedge of the variability in cash flows of a forecasted transaction or of amounts to be received

or paid related to a recognized asset or liability (“cash flow” hedge), (3) a hedge of a net investment in a foreign operation (“net

investment” hedge) or (4) held for other investment and/or risk management purposes, which primarily involve managing asset or

liability related risks which do not qualify for hedge accounting.

Fair Value Hedges

Changes in the fair value of a derivative that is designated and qualifies as a fair value hedge, including foreign-currency fair value

hedges, along with the changes in the fair value of the hedged asset or liability that is attributable to the hedged risk, are recorded in

current period earnings with any differences between the net change in fair value of the derivative and the hedged item representing the

hedge ineffectiveness. Periodic cash flows and accruals of income/expense (“periodic derivative net coupon settlements”) are recorded

in the line item of the consolidated statements of operations in which the cash flows of the hedged item are recorded.

Cash Flow Hedges

Changes in the fair value of a derivative that is designated and qualifies as a cash flow hedge, including foreign-currency cash flow

hedges, are recorded in AOCI and are reclassified into earnings when the variability of the cash flow of the hedged item impacts

earnings. Gains and losses on derivative contracts that are reclassified from AOCI to current period earnings are included in the line

item in the consolidated statements of operations in which the cash flows of the hedged item are recorded. Any hedge ineffectiveness is

recorded immediately in current period earnings as net realized capital gains and losses. Periodic derivative net coupon settlements are

recorded in the line item of the consolidated statements of operations in which the cash flows of the hedged item are recorded.

Net Investment in a Foreign Operation Hedges

Changes in fair value of a derivative used as a hedge of a net investment in a foreign operation, to the extent effective as a hedge, are

recorded in the foreign currency translation adjustments account within AOCI. Cumulative changes in fair value recorded in AOCI are

reclassified into earnings upon the sale or complete, or substantially complete, liquidation of the foreign entity. Any hedge

ineffectiveness is recorded immediately in current period earnings as net realized capital gains and losses. Periodic derivative net

coupon settlements are recorded in the line item of the consolidated statements of operations in which the cash flows of the hedged item

are recorded.

Other Investment and/or Risk Management Activities

The Company’ s other investment and/or risk management activities primarily relate to strategies used to reduce economic risk or

replicate permitted investments and do not receive hedge accounting treatment. Changes in the fair value, including periodic derivative

net coupon settlements, of derivative instruments held for other investment and/or risk management purposes are reported in current

period earnings as net realized capital gains and losses.

Hedge Documentation and Effectiveness Testing

To qualify for hedge accounting treatment, a derivative must be highly effective in mitigating the designated changes in fair value or

cash flow of the hedged item. At hedge inception, the Company formally documents all relationships between hedging instruments and

hedged items, as well as its risk-management objective and strategy for undertaking each hedge transaction. The documentation process

includes linking derivatives that are designated as fair value, cash flow, or net investment hedges to specific assets or liabilities on the

balance sheet or to specific forecasted transactions and defining the effectiveness and ineffectiveness testing methods to be used. The

Company also formally assesses both at the hedge’ s inception and ongoing on a quarterly basis, whether the derivatives that are used in

hedging transactions have been and are expected to continue to be highly effective in offsetting changes in fair values or cash flows of

hedged items. Hedge effectiveness is assessed using qualitative and quantitative methods. Qualitative methods may include

comparison of critical terms of the derivative to the hedged item. Quantitative methods include regression or other statistical analysis of

changes in fair value or cash flows associated with the hedge relationship. Hedge ineffectiveness of the hedge relationships are

measured each reporting period using the “Change in Variable Cash Flows Method”, the “Change in Fair Value Method”, the

“Hypothetical Derivative Method”, or the “Dollar Offset Method”.