The Hartford 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

The security-specific collateral review is performed to estimate potential future losses. This review incorporates assumptions about

expected future collateral cash flows, including projected rental rates and occupancy levels that varied based on property type and sub-

market. The results of the security-specific collateral review allowed the Company to estimate the expected timing of a security’ s first

loss, if any, and the probability and severity of potential ultimate losses. The Company then discounted these anticipated future cash

flows at the security’ s book yield prior to impairment.

Included in corporate and equity security types were direct private investments that were impaired primarily due to the likelihood of a

disruption in contractual principal and interest payments due to the restructuring of the debtor’ s obligation. Impairments on equity

securities were primarily related to preferred stock associated with these direct private investments.

Impairments on securities for which the Company has the intent to sell were primarily on corporate bonds, certain ABS aircraft bonds

and CMBS as market pricing continues to improve and the Company would like the ability to reduce certain exposures.

In addition to the credit impairments recognized in earnings, the Company recognized non-credit impairments in other comprehensive

income of $89 for the year ended December 31, 2011, predominantly concentrated in CRE CDOs and RMBS. These non-credit

impairments represent the difference between fair value and the Company’ s best estimate of expected future cash flows discounted at

the security’ s effective yield prior to impairment, rather than at current market implied credit spreads. These non-credit impairments

primarily represent increases in market liquidity premiums and credit spread widening that occurred after the securities were purchased,

as well as a discount for variable-rate coupons which are paying less than at purchase date. In general, larger liquidity premiums and

wider credit spreads are the result of deterioration of the underlying collateral performance of the securities, as well as the risk premium

required to reflect future uncertainty in the real estate market.

Future impairments may develop as the result of changes in intent to sell of specific securities or if actual results underperform current

modeling assumptions, which may be the result of, but are not limited to, macroeconomic factors and security-specific performance

below current expectations. Ultimate loss formation will be a function of macroeconomic factors and idiosyncratic security-specific

performance.

Year ended December 31, 2010

For the year ended December 31, 2010, impairments recognized in earnings were comprised of credit impairments of $372 primarily

concentrated on structured securities associated with commercial and residential real estate. Also included were impairments on debt

securities for which the Company intended to sel1 of $54, mainly comprised of CMBS bonds in order to take advantage of price

appreciation, as well as impairments on equity securities of $8 primarily on below investment grade securities depressed 20% for more

than six months.

Year ended December 31, 2009

Impairments recognized in earnings were comprised of credit impairments of $1.2 billion primarily concentrated on CRE CDOs, below-

prime RMBS and CMBS. Also included were impairments on debt securities for which the Company intended to sell of $156, mainly

comprised of corporate financial services securities, as well as impairments on equity securities of $136 related to below investment

grade hybrid securities.

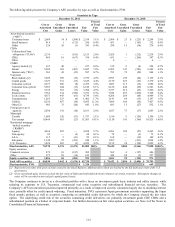

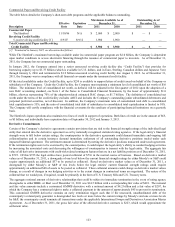

Valuation Allowances on Mortgage Loans

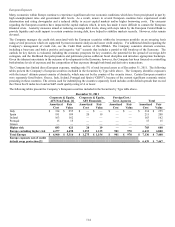

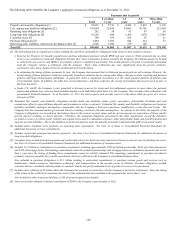

The following table presents (additions)/reversals to valuation allowances on mortgage loans.

For the years ended December 31,

2011

2010

2009

Credit-related concerns

$

27

$

(70)

$

(310)

Held for sale

Agricultural loans

(3)

(10)

(4)

B-note participations

—

(22)

(51)

Mezzanine loans

—

(52)

(43)

Total

$

24

$

(154)

$

(408)

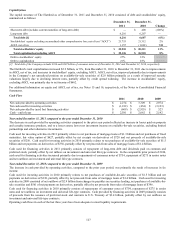

Year ended December 31, 2011

For the year ended December 31, 2011, valuation allowances on mortgage loan reversals of $24 were largely driven by the release of a

reserve associated with the sale of a previously reserved for mezzanine loan. Continued improvement in commercial real estate

property valuations will positively impact future loss development, with future impairments driven by idiosyncratic loan-specific

performance. Excluded from the table above are valuation allowances associated with mortgage loans related to the divestiture of

Federal Trust Corporation. For further information regarding the divestiture of Federal Trust Corporation, see Note 20 of the Notes to

the Consolidated Financial Statements.

Years ended December 31, 2010 and 2009

For the years ended December 31, 2010 and 2009, valuation allowances on mortgage loan additions of ($154) and ($408), respectively,

primarily related to B-Note participant and mezzanine loan sales. Also included were additions for expected credit losses due to

borrower financial difficulty and/or collateral deterioration.