The Hartford 2011 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-85

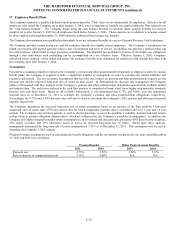

17. Employee Benefit Plans (continued)

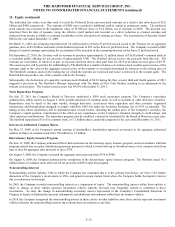

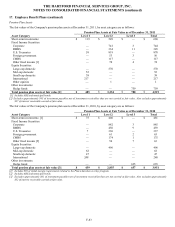

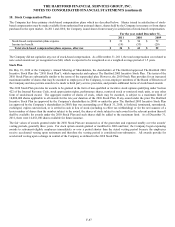

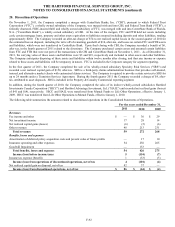

Other Postretirement Plan Assets

The fair value of the Company’ s other postretirement plan assets at December 31, 2011, by asset category are as follows:

Other Postretirement Plan Assets

at Fair Value as of December 31, 2011

Asset Category

Level 1

Level 2

Level 3

Total

Short-term investments

$

—

$

9

$

—

$

9

Fixed Income Securities:

Corporate

—

53

—

53

RMBS

—

48

—

48

U.S. Treasuries

—

28

—

28

Foreign government

—

2

—

2

CMBS

—

18

—

18

Other fixed income

—

4

—

4

Equity Securities:

Large-cap

—

43

—

43

Total other postretirement plan assets at fair value [1]

$

—

$

205

$

—

$

205

[1] Excludes approximately $3 of investment payables net of investment receivables that are not carried at fair value. Also excludes approximately $1

of interest receivable carried at fair value.

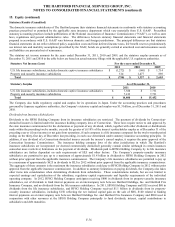

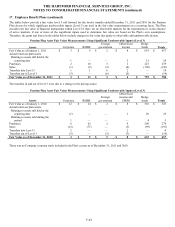

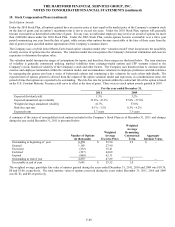

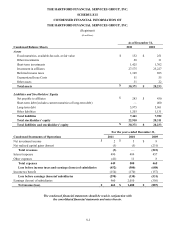

The fair value of the Company’ s other postretirement plan assets at December 31, 2010, by asset category are as follows:

Other Postretirement Plan Assets

at Fair Value as of December 31, 2010

Asset Category

Level 1

Level 2

Level 3

Total

Short-term investments

$

—

$

10

$

—

$

10

Fixed Income Securities:

Corporate

—

57

—

57

RMBS

—

44

—

44

U.S. Treasuries

—

19

—

19

CMBS

—

17

—

17

Other fixed income

—

6

—

6

Equity Securities:

Large-cap

—

43

—

43

Total other postretirement plan assets at fair value [1]

$

—

$

196

$

—

$

196

[1] Excludes approximately $7 of investment payables net of investment receivables that are not carried at fair value. Also excludes approximately $1

of interest receivable carried at fair value.

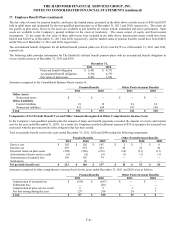

There was no Company common stock included in the other postretirement benefit plan assets as of December 31, 2011 and 2010.

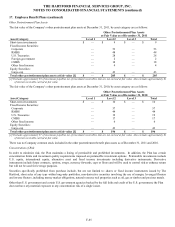

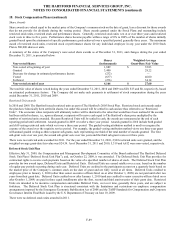

Concentration of Risk

In order to minimize risk, the Plan maintains a listing of permissible and prohibited investments. In addition, the Plan has certain

concentration limits and investment quality requirements imposed on permissible investment options. Permissible investments include

U.S. equity, international equity, alternative asset and fixed income investments including derivative instruments. Derivative

instruments include future contracts, options, swaps, currency forwards, caps or floors and will be used to control risk or enhance return

but will not be used for leverage purposes.

Securities specifically prohibited from purchase include, but are not limited to: shares or fixed income instruments issued by The

Hartford, short sales of any type within long-only portfolios, non-derivative securities involving the use of margin, leveraged floaters

and inverse floaters, including money market obligations, natural resource real properties such as oil, gas or timber and precious metals.

Other than U.S. government and certain U.S. government agencies backed by the full faith and credit of the U.S. government, the Plan

does not have any material exposure to any concentration risk of a single issuer.