The Hartford 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

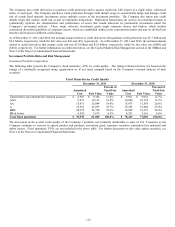

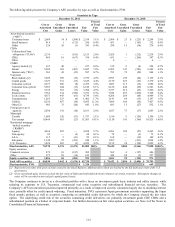

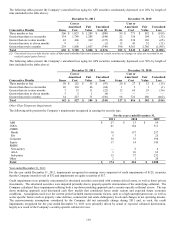

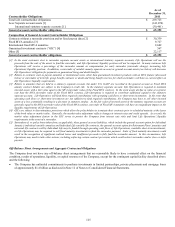

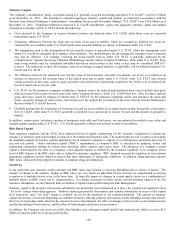

The following tables present the Company’ s unrealized loss aging for AFS securities continuously depressed over 20% by length of

time (included in the table above).

December 31, 2011 December 31, 2010

Consecutive Months

Items

Cost or

Amortized

Cost

Fair

Value

Unrealized

Loss [1]

Items

Cost or

Amortized

Cost

Fair

Value

Unrealized

Loss

Three months or less

206

$

1,823

$

1,289

$

(500)

99

$

771

$

582

$

(189)

Greater than three to six months

134

1,749

1,205

(544)

22

136

104

(32)

Greater than six to nine months

42

406

269

(137)

28

234

169

(65)

Greater than nine to eleven months

9

1

—

(1)

13

43

32

(11)

Greater than twelve months

239

1,806

1,057

(749)

390

4,361

2,766

(1,595)

Total

630

$

5,785

$

3,820

$

(1,931)

552

$

5,545

$

3,653

$

(1,892)

[1] Unrealized losses exclude the fair value of bifurcated embedded derivative features of certain securities as changes in value are recorded in net

realized capital gains (losses).

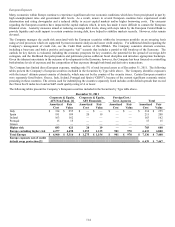

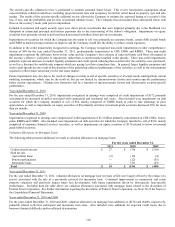

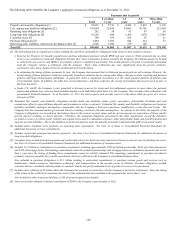

The following tables present the Company’ s unrealized loss aging for AFS securities continuously depressed over 50% by length of

time (included in the tables above).

December 31, 2011 December 31, 2010

Consecutive Months

Items

Cost or

Amortized

Cost

Fair

Value

Unrealized

Loss

Items

Cost or

Amortized

Cost

Fair

Value

Unrealized

Loss

Three months or less

50

$

152

$

55

$

(97)

20

$

27

$

12

$

(15)

Greater than three to six months

26

110

46

(64)

1

2

1

(1)

Greater than six to nine months

7

33

11

(22)

12

65

29

(36)

Greater than nine to eleven months

5

5

1

(4)

—

—

—

—

Greater than twelve months

54

227

71

(156)

94

722

260

(462)

Total

142

$

527

$

184

$

(343)

127

$

816

$

302

$

(514)

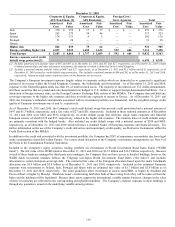

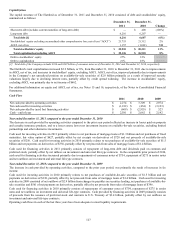

Other-Than-Temporary Impairments

The following table presents the Company’ s impairments recognized in earnings by security type.

For the years ended December 31,

2011

2010

2009

ABS

$

27

$

13

$

54

CDOs

41

164

511

CMBS

Bonds

16

157

257

IOs

5

3

25

Corporate

50

33

198

Equity

17

14

145

RMBS

Non-agency

—

2

4

Alt-A

1

10

62

Sub-prime

15

37

232

Other

2

1

20

Total

$

174

$

434

$

1,508

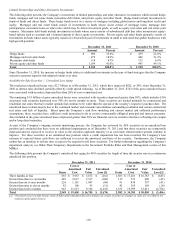

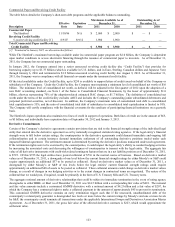

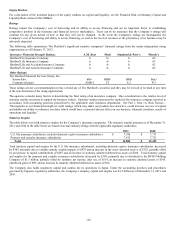

Year ended December 31, 2011

For the year ended December 31, 2011, impairments recognized in earnings were comprised of credit impairments of $125, securities

that the Company intends to sell of $32 and impairments on equity securities of $17.

Credit impairments were primarily concentrated in structured securities associated with commercial real estate, as well as direct private

investments. The structured securities were impaired primarily due to property-specific deterioration of the underlying collateral. The

Company calculated these impairments utilizing both a top down modeling approach and a security-specific collateral review. The top

down modeling approach used discounted cash flow models that considered losses under current and expected future economic

conditions. Assumptions used over the current period included macroeconomic factors, such as a high unemployment rate, as well as

sector specific factors such as property value declines, commercial real estate delinquency levels and changes in net operating income.

The macroeconomic assumptions considered by the Company did not materially change during 2011 and, as such, the credit

impairments recognized for the year ended December 31, 2011 were primarily driven by actual or expected collateral deterioration,

largely as a result of the Company’s security-specific collateral review.